It’s All About Supply and Demand

The story of our real estate market always is about supply and demand. For real estate prices to drop, supply needs to go noticeably increase, and/or demand needs noticeably decrease. Does this make sense? On the other hand, for prices to go up, the supply must remain low while demand remains high. Fair enough? Of course, other factors that come into play, but at the core, it’s always about whether we have enough properties for sale for those looking to buy and do we have enough buyers for those looking to sell.

With this in mind, let’s take a look at supply and demand this week on Florida’s Emerald Coast.

Supply

Recently we looked at new listings and saw that the number of new properties coming on the market are either down or flat. This tells us that sellers are choosing to sit this market out and are not putting their properties up for sale. At least for now.

But we also see that inventory (supply) is going up, how can that be? Well, I believe it’s because a lot of properties are not selling and therefore are sitting on the market as buyers pull back because of affordability issues. So even if fewer properties are coming on the market the overall inventory is increasing because of the drop in selloff of existing inventory. Here’s what I mean.

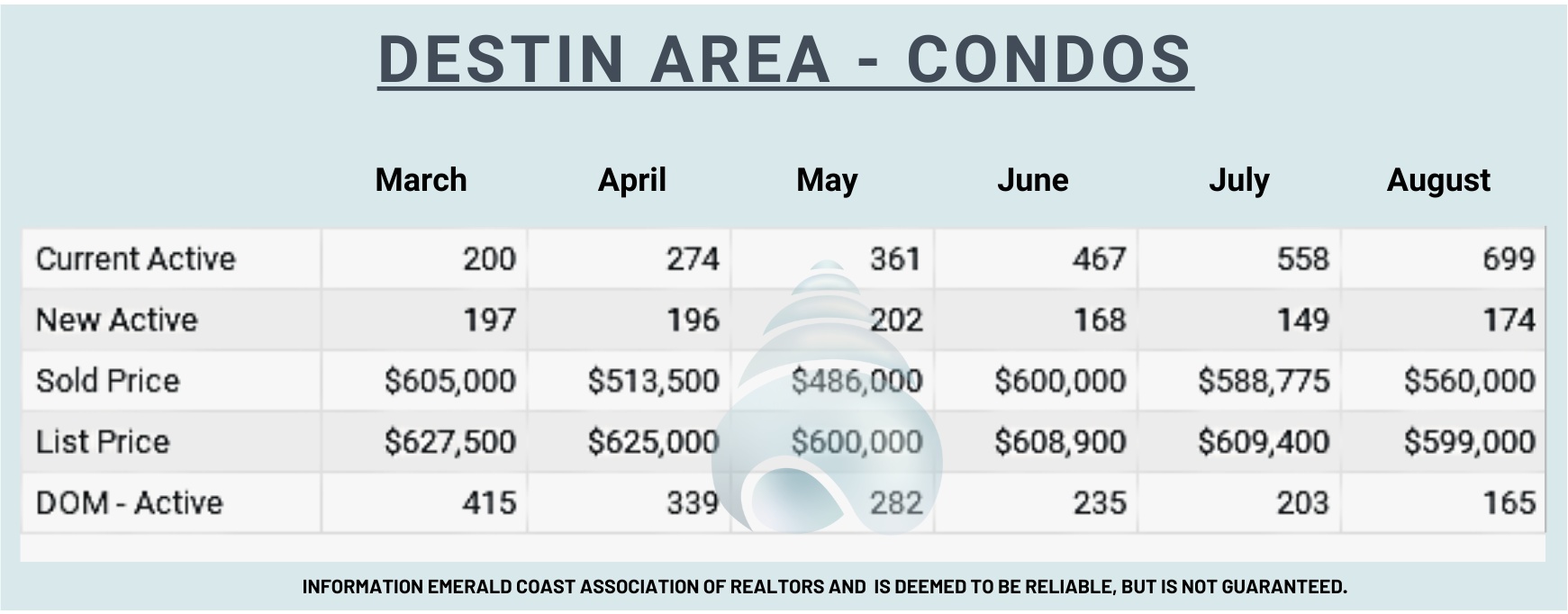

Destin Condo Sales Data

Note 1: Total Number of Active Listings

The number of Total Number of Current Active Listings is growing each month but look at the New Active Listings, they are mostly flat or down.

Note 2: Median Sold Prices

Look at the sold prices. The impact of overall increasing of supply on Destin condo prices so far has been a softening of sold prices but not a crash. List prices are showing the same tendency.

Note 3: Days On Market

DOM (Days On Market) Then number of days on market has been dropping over the last six months which would indicate that demand is still strong and there are buyers willing to buy properties regardless of price, mortgage rates and the cost to own. That is a strange contradiction with the growing inventory. Weird.

Summary

Look for Destin Condo prices to soften but probably not crash.

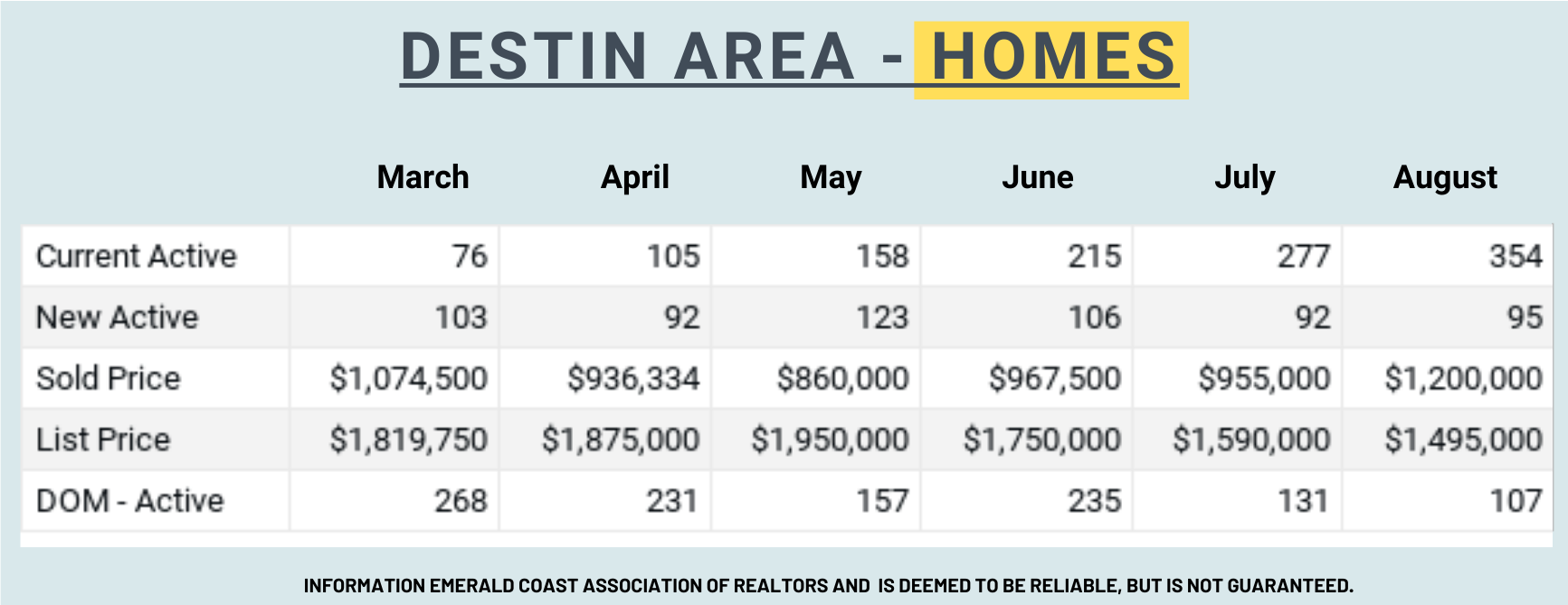

Destin Home Sales Data

Looking at the number for Destin Homes it appears they are seeing the similar results as Destin Condos.

Note 1: Total Number of Active Listings

The number of Total Number of Current Active Listings is growing each month but the number of New Active Listings is not, so it’s one of those cases where inventory is going up but at a decreasing rate.

Note 2: Sold Prices

The impact of overall increasing of supply on Destin homes prices seemed to be having the expected effect on prices but then that trend reversed and now we see an increase in sold prices. However, look at the list prices, they are going down. We will watch this closely as we go forward into the fall.

Note 3: Days On Market

DOM (Days On Market) The number of days on market has been up and down but generally dropping over the last six months which would indicate that demand is still strong and there are buyers willing to buy properties regardless of price, mortgage rates and the cost to own.

Summary:

Look for prices of Destin Homes to soften but probably not crash.

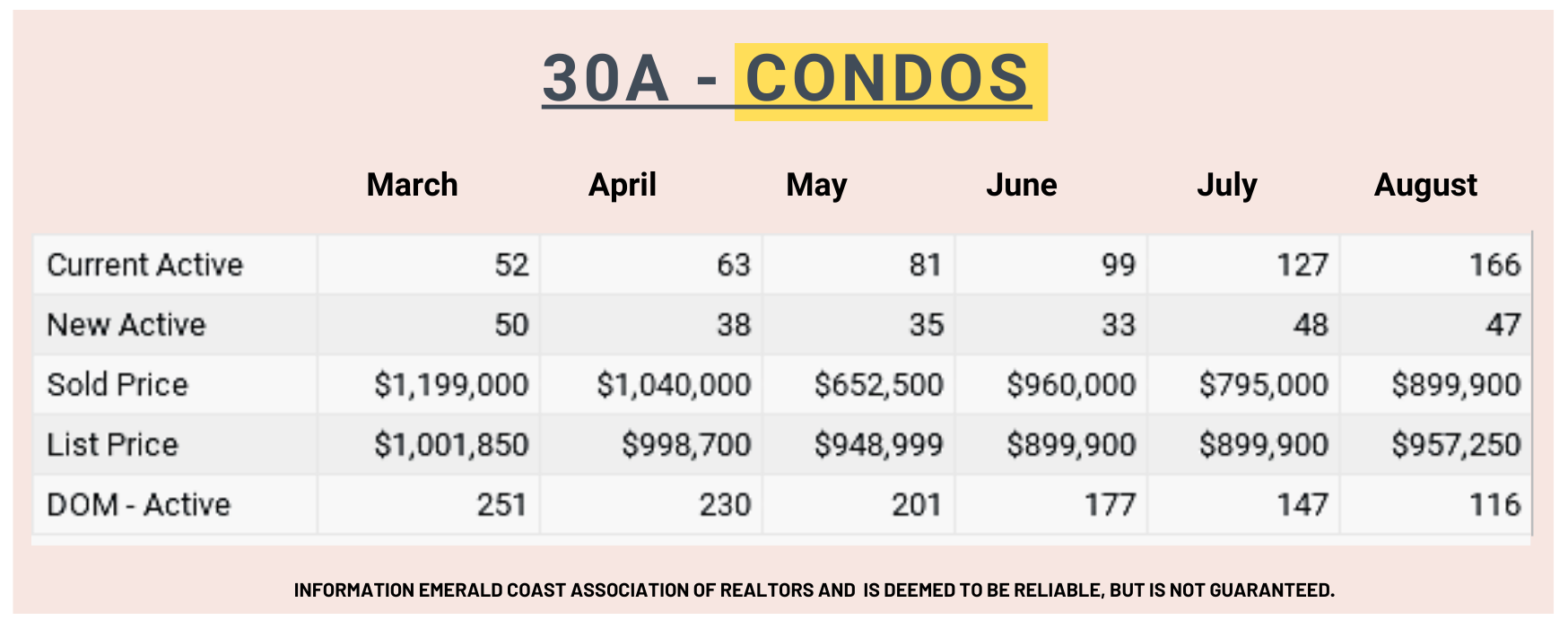

30A Condo Sales Data

Looking at the numbers for 30A Condos it appears they are seeing the same results as Destin Area Condos.

Note 1: Total Number of Active Listings

The number of Total Number of Current Active Listings is growing each month, more than tripling since March, but the number of New Active Condo Listings has dropped substantially over the last six months. This is a pattern we are seeing across the Emerald Coast.

Note 2: Sold Prices

The impact of overall increasing of supply on 30A Condo prices so far has had little to no impact on sales prices. They aren’t up much but they aren’t down either. List prices are trending down so that may be a harbinger of things to come.

Note 3: Days On Market

DOM (Days On Market) Then number of days on market has been dropping over the last six months which would indicate that demand is still strong and there are buyers willing to buy properties regardless of price, mortgage rates and the cost to own. Again, this runs contradictory to the inventory.

Summary:

Look for 30A Condo prices to soften but probably not crash.

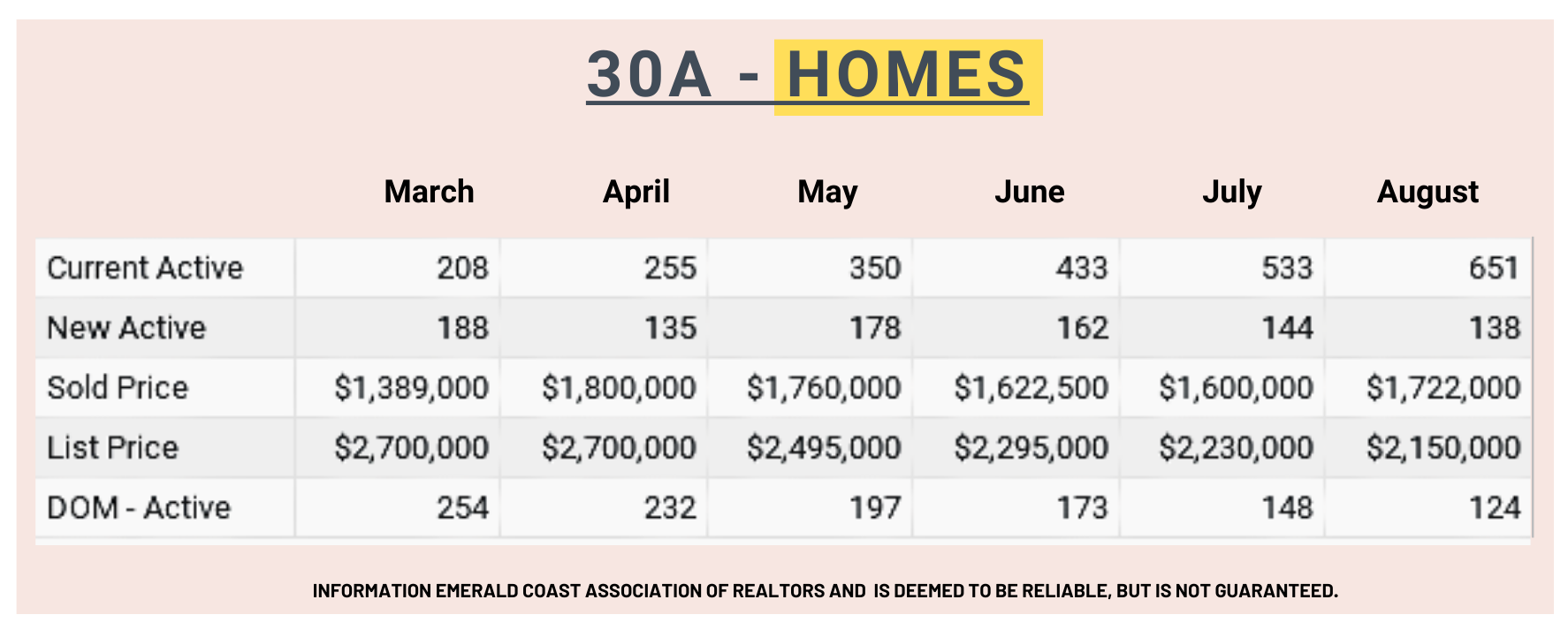

30A Home Sales Data

Looking at the numbers for 30A Homes it appears they are seeing the same results as Destin Area Homes.

Note 1: Total Number of Active Listings

The number of Total Number of Current Active Listings is growing each month, more than tripling since March, but the number of New Active Home Listings has dropped substantially over the last six months.

Note 2: Sold Prices

The impact of overall increasing of supply on 30A Homes prices so far has had little to no impact on sales prices. They aren’t up much but they aren’t down either. List prices are trending down so that may be a harbinger of things to come.

Note 3: Days On Market

DOM (Days On Market) Then number of days on market has been dropping over the last six months which would indicate that demand is still strong and there are buyers willing to buy properties regardless of price, mortgage rates and the cost to own. Again, this runs contradictory to the inventory.

Summary:

Look for 30A Home prices to soften but probably not crash.

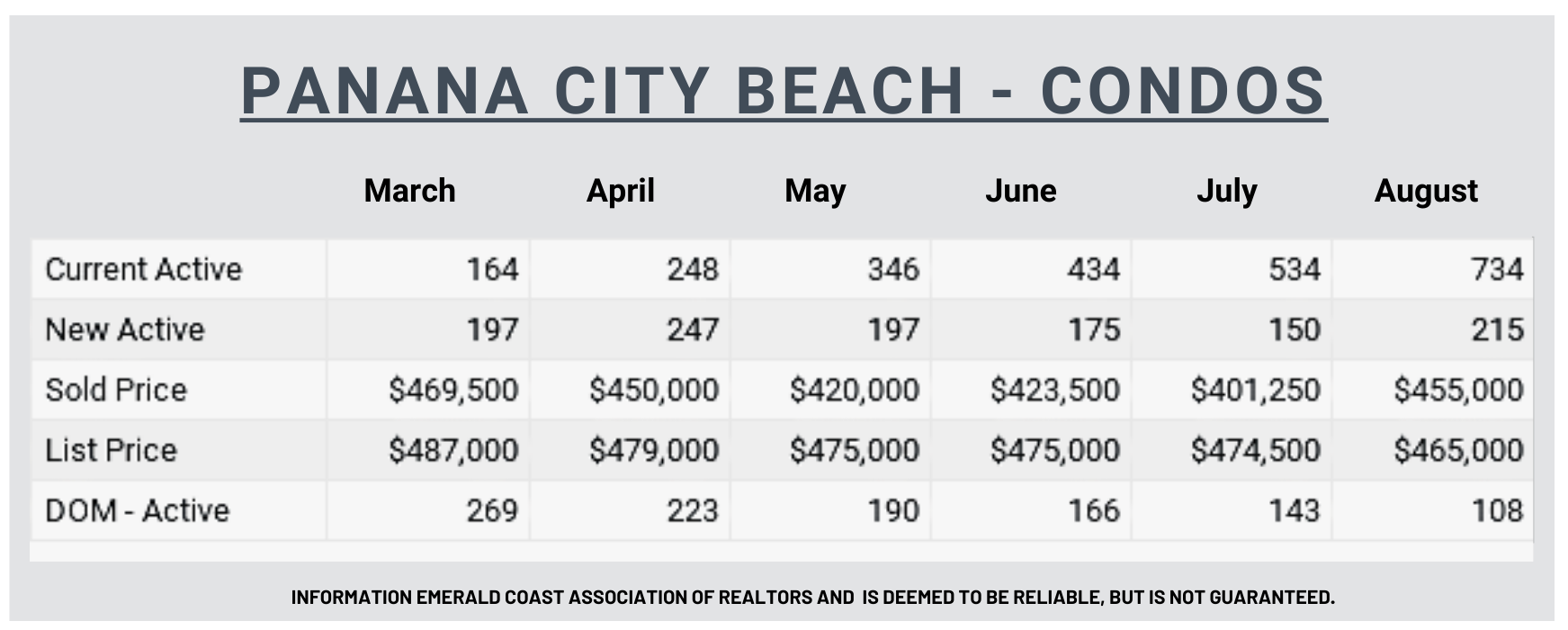

Panama City Beach Condo Sales Data

Looking at the numbers for Panama City Beach Condo Sales it appears they are seeing the same results as the rest of the Emerald Coast.

Note 1: Total Number of Active Listings

The number of Total Number of Current Active Listings has grown steadily over the last six months, going from 164 in March to over 700 in August. However the number of New Active Condo Listings has not seen that same increase. It’s jumped around a bit and we did a see a big jump in August. That is likely sellers cashing out after the summer rental season.

Note 2: Sold Prices

The sold prices are interesting as they were eroding on a fairly regular basis each month until August where they jumped up. That is a strange contradiction that we will have to keep an eye on.

Note 3: Days On Market

DOM (Days On Market) Then number of days on market has been dropping over the last six months which would indicate that demand is still strong and there are buyers willing to buy properties regardless of price, mortgage rates and the cost to own. Again, this runs contradictory to the inventory but in line with August sold prices.

Summary:

Look for Panama City Beach Condo prices to remain high, or at least not drop beyond normal end of the rental season adjustment.

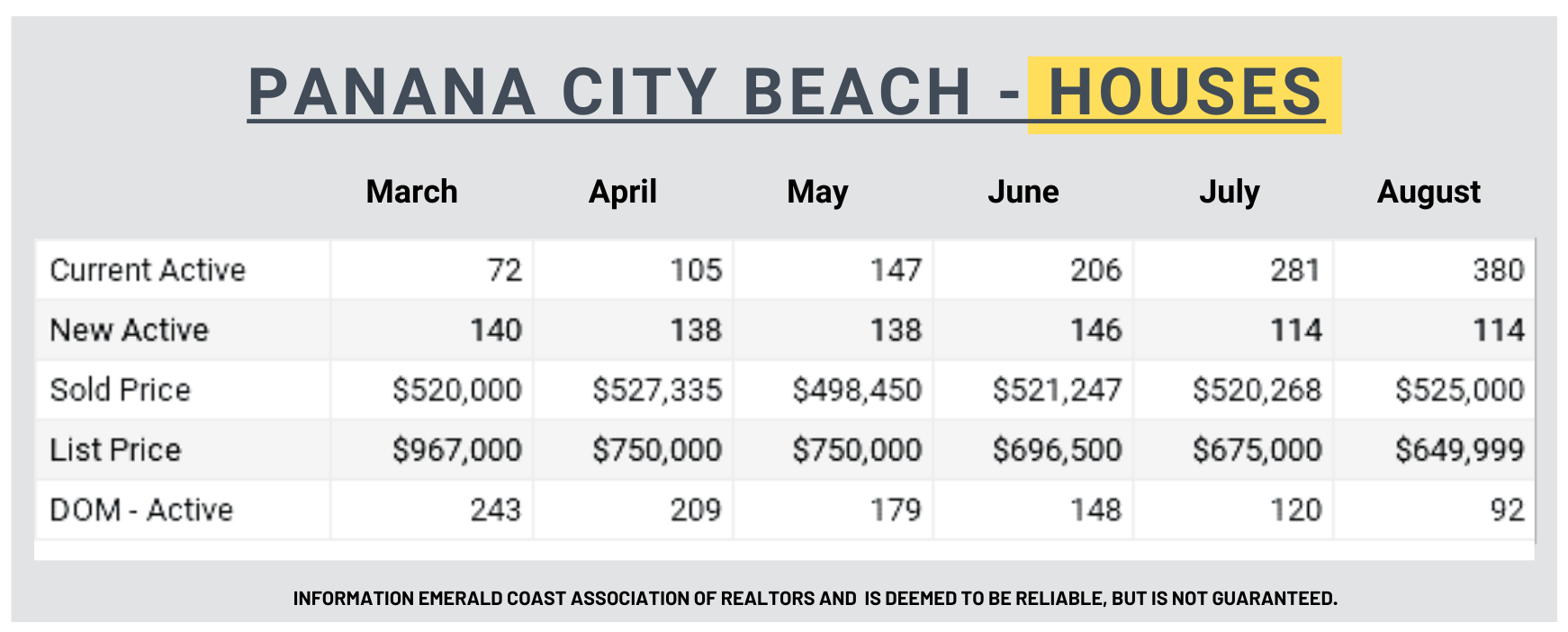

Panama City Beach Home Sales Data

Looking at the numbers for Panama City Beach Home Sales it appears they are seeing the same results as the rest of the Emerald Coast.

Note 1: Total Number of Active Listings

The number of Total Number of Current Active Listings has jumped dramatically over the last six months, going from 72 in March to over 380 in August. Again, the number of New Active Home Listings is going the other way. It’s interesting that we didn’t see the same jump in homes for sale as we did with the condos.

Note 2: Sold Prices

The sold prices for homes in Panama City Beach couldn’t be more consistent. Take a look at the list prices though, they are dropping in a pretty big way. That will be something to watch as we move into the fall.

Note 3: Days On Market

DOM (Days On Market) Then number of days on market has been dropping over the last six months which would indicate that demand is still strong and there are buyers willing to buy properties regardless of price, mortgage rates and the cost to own. Again, this runs contradictory to the inventory. I bet that lower list prices has a lot to do with it.

Summary:

Look for Panama City Beach Home prices start to soften, perhaps as much as 20%.

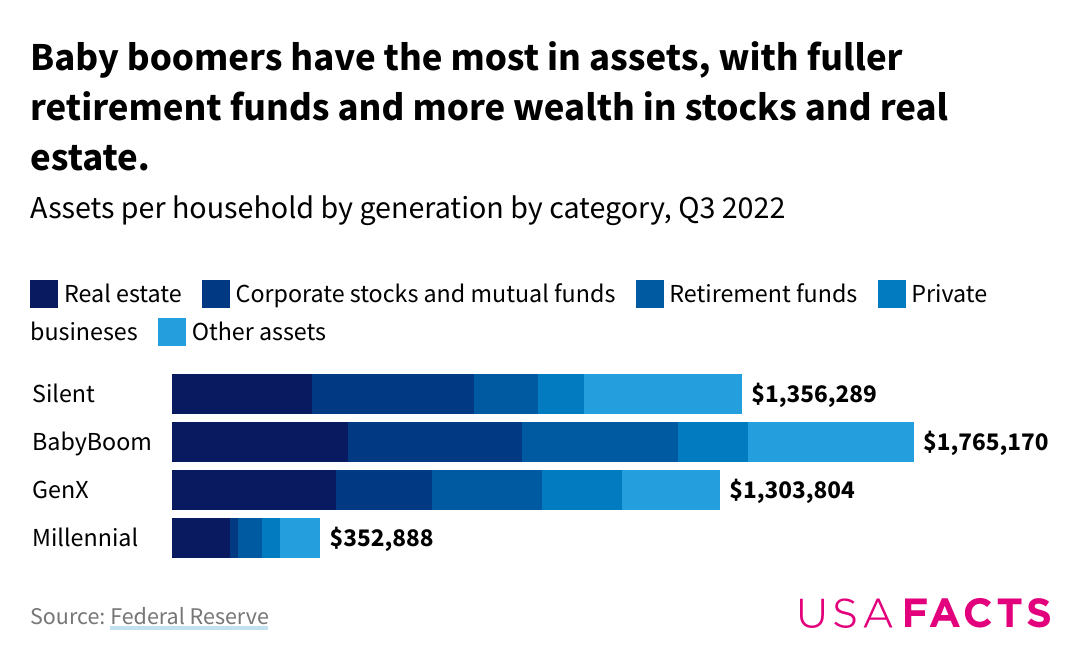

Demand:

Why Are Prices Staying High?

Again, it’s simply supply and demand. Looking at the demand side of things it’s clear that Baby Boomers (69 million people) at the end of their careers with plenty of funds and the willingness to spend them on places at the beach are and will continue to be a major player in our real estate market.

More about Baby Boomers

Baby Boomers are the wealthiest generation, holding 70% of the disposable income in the U.S. and spending over $548 billion a year, and they also they spend more than any other generation, across all categories. Here’s the reality, they don’t care about mortgage rates or cost to own. They have the money and want to live where and how they want to and it’s showing up in Florida real estate demand.

The National Association of Realtors said in March that baby boomers now make up 39% of home buyers — the most of any generation — and an increase from 29% last year.

Bottom Line

There is literally a wave of people who want to own in Florida and have to means to pay whatever price they have to in order to be here. Look for this group to provide the demand necessary to keep prices high in Florida.

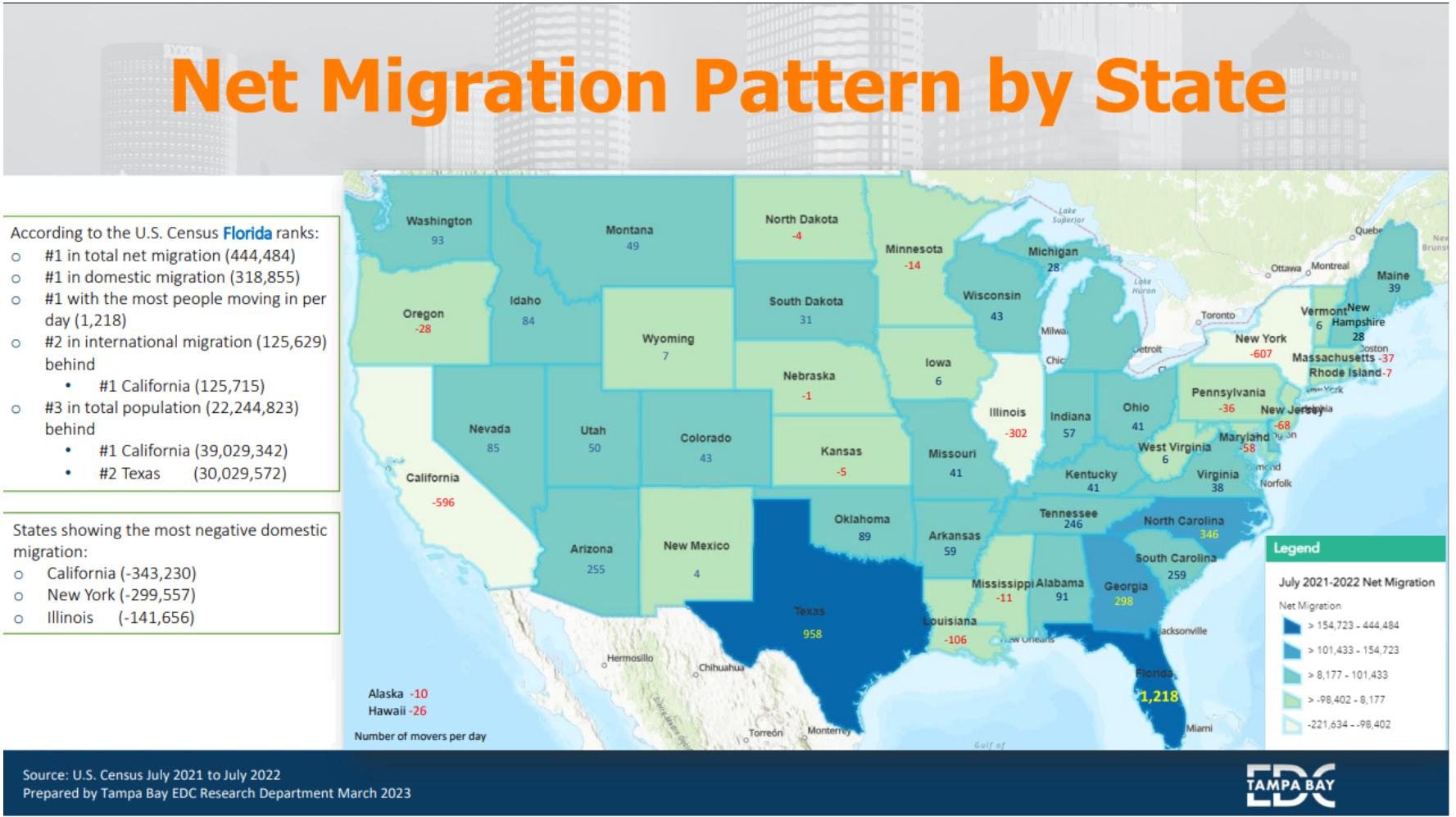

Domestic Migration Patterns

People Are Moving To Florida

When more people move to an area (Region, State, County, City) the demand goes up and puts a ton of pressure on supply to keep up.

Bottom Line

By all accounts the supply of homes available over time is going to be severely under supplied so – over time – look for prices to continue to go up in Florida in general and in North West Florida specifically.

Is there good news for buyers?

Markets are always adjusting to what is happening in the short term. We know that long term Florida real estate is going to be in high demand and therefore very expensive, however we also know that the Fed is working very hard to get inflation under control and part of that effort is to get the prices of real estate down, if even only temporarily, and that is going to create some buying opportunities.

Foreclosures Coming?

As an example a Realtor who used to do a lot of bank owned property sales (REO) and Foreclosures posted the other day that he picked up his first REO property in a long time. This will be an opportunity for some buyers. I don’t think there will be a ton of foreclosures but there will be enough that if you are watching for them you can get a great deal.

Foreclosure Alert

If you would like have Foreclosures emailed to you as soon as they hit the market – email me at info@johnmoranrealtor.com and I will make sure they hit your inbox as soon as they hit the market.

What Should You Do?

We are wealth builders, so our goal (whether you are buying or selling) is to build or protect your wealth – based on your financial goals and the current market conditions. Call us today and lets talk about how you can max out your position as a buyer, a seller or as an owner to continue building your family’s wealth well into the future.

Committed to your success,

John Moran – CEO

The Smart Beach Investor | Keller Williams Realty AT THE BEACH TEAM We Make Real Estate Easy.