What’s the real estate market like right now?

There is a classic staredown happening right now between buyers and sellers here at the beach. Who blinks first will determine where the market goes in 2023 and who the winners and losers will be. To get a better feel of the economics we need to take a look at both the supply and demand sides of the market for clues that will tell us… who might blink first?

Let’s look at the Demand Side

There are many factors that impact the demand side of the equation and cost is perhaps the largest one.

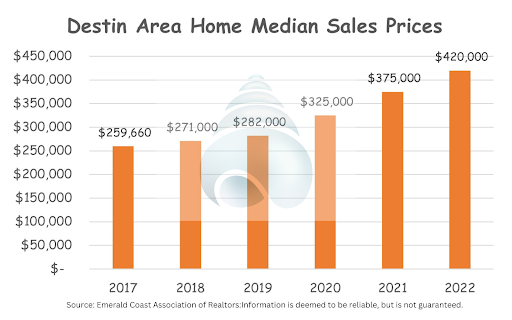

Cost of Real Estate

With this in mind, the cost to buy real estate has jumped dramatically over the last three years. The result of these jumps in cost to buy is a reduction in the number of buyers that can afford to buy a place here at the beach. Of those that can still afford to buy, many more are simply deciding it doesn’t make sense at the current asking prices and are choosing to forgo buying right now.

Cost of Money

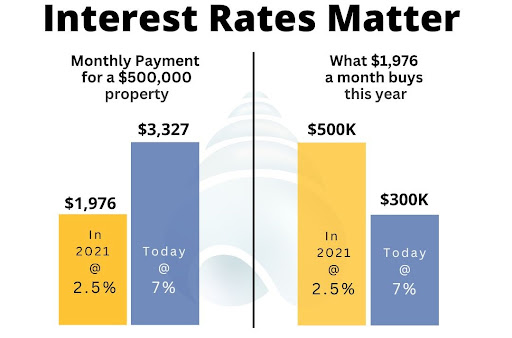

A second massive cost impacting demand for real estate here at the beach is the cost of money. Mortgage rates are up to a cost we haven’t seen in twenty years. Mortgage rates have doubled since the start of the year, jumping from 3.22% to a 20-year high of 7.08% in October.

How this matters: Last year a buyer could afford to pay a seller $500,000 for a house or condo and their monthly mortgage payment would have been $1,976. Now that same purchase would cost $3,327 per month. Or looking at it the other way, if a buyer has to hold to a $1,976 monthly mortgage payment now they can only afford to pay $300,000 for a property. Clearly interest rates have a huge impact on where our market will go in the coming months.

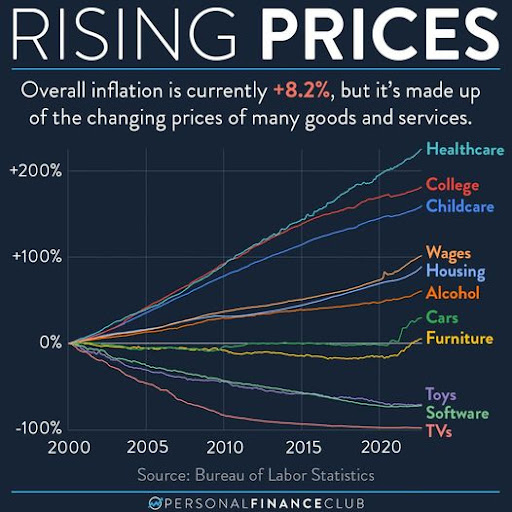

Cost of Everything

The third leg of the stool that is sitting squarely on top of buyer demand is Inflation. It simply costs more right now for everything. Food, fuel, technology, cars… everything. The Consumer Price Index (CPI) is higher than we have seen in 20+ years. Because of this, folks are feeling pinched in the wallet. That is causing things like vacations at the beach to be skipped or at least shortened by a few days. Of course, this leads to less rental income for owners which puts a further strain on their ability to carry the property through a down cycle.

In sum.

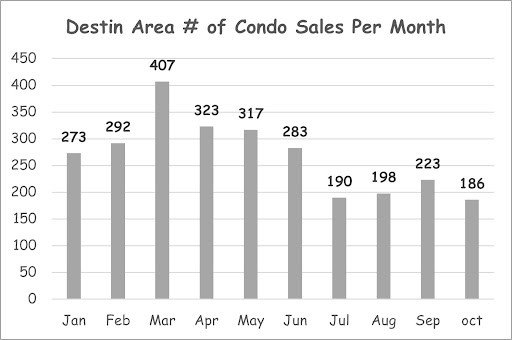

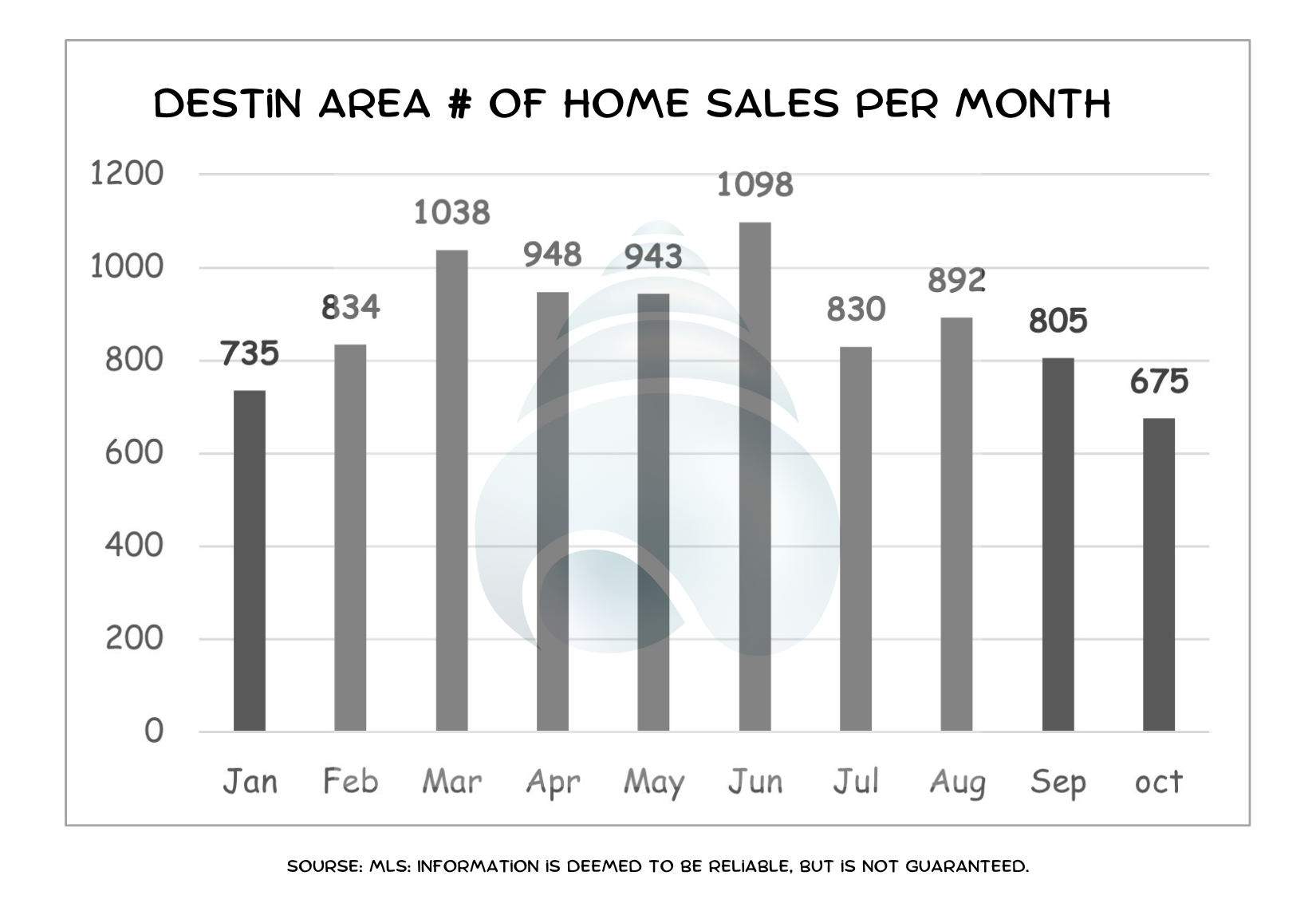

The cumulative result of all these increases in costs is a dramatic decrease in the number of properties sold. It really starts to show up in our area in July.

Looking at the Demand Side it would seem that price drops are imminent and good times are ahead for buyers seeking better deals. Right? Maybe.

Note: Condos generally represent a more consolidated market of investor properties while the home sales include a higher degree of primary residences… so that needs to be factored into the equation.

Let’s Look at the other side of the equation now – Supply

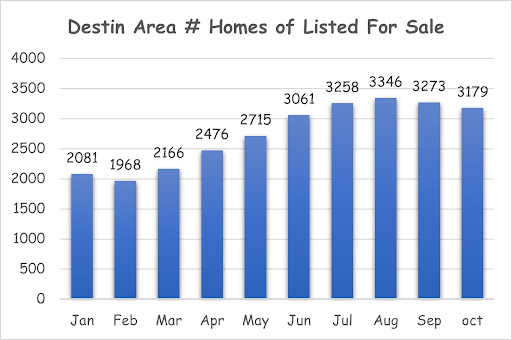

A wise man once told me that in order for prices to come down the supply of property for sale has to go up. If sellers have to compete with an abundance of other sellers typically the way to do that is by lowering the price.

Okay, fair enough. Is the inventory of homes and condos for sale here at the beach going up so that prices will get pushed down? Short answer is no. The slightly longer answer is… Not yet.

What To Do?

Okay, what does all this mean for property owners at the beach and for folks looking to buy to use or as an investment? In other words, is now a good time to buy or sell?

The honest answer? Maybe or even better… it depends.

Example:

Let’s say a property recently sold for $900,000 setting the price for a building or neighborhood. The buyer is a flipper and decides to put it on the market at $1M trying to make a quick buck and get out. But they end up sitting with little or no interest.

A second seller comes on the market and because they bought in a few years ago at $500,000 and are happy with a sales price of $900,000 they list at $950,000 effectively pushing the seller at $1M to the outer edge of likely. Because the market is in a spin cycle right now their property sits as well.

A third seller comes to market and they have to get out. They need the money. They bought right and to ensure a quick deal together they list at $875,000. This puts seller #1 underwater and forces seller #2 to decide what to do. If #2 stays at their now high price of $950,000 and the new property sells for $875,000 (or less) they will be in a position of having a high price in a declining market and forced to chase the market down or get out.

Then if buyer #1 runs into liquidity problems (loses their job) and is forced to sell at a loss. Or what if a new seller with a ton of equity jumps in because they are worried the market is collapsing and are happy selling at a low but high enough price of $865,000? The race to the bottom will be on. How long it takes to get there, how far down it goes, and how long it takes to get back will be determined. In other words… the Sellers Blinked.

Our Advice – Protect your wealth

If you are a long term investor (not a flipper or someone at the end of their ownership cycle) then you can afford to ride out the storm. You may even want to get ready to add a property if prices drop far enough.

If you are a short term owner and looking at selling in the next couple of years you may want to sell now while we know prices are high. We saw back in the day that when prices dropped they dropped fast, they dropped deep, and they took a long time to get back. I don’t know how far prices will correct this time or how deep the correction will be, or how long it will take to get back to the high prices again. But it could be a while. Be careful.

If you are a buyer and plan on holding it for a long time then go after the best deal you can get, max out your rental income and ride the market until the time is right to sell. After the Great Recession it took 17 years for prices to get back to the 2005 highs again but… but… if owners invested in 05, collected an average of $15,000 in annual positive cash flow they would have collected $255,000 in rental income and had someone else (renters) pay of 17 years worth of mortgage cost. Not to mention, tax write offs, deprecation and many cash out refinance opportunities. All pretty good options.

If you are buying to flip and grab quick cash… be very careful.

Bottom Line

We are wealth builders, so our goal (whether you are buying or selling) is to build or protect your wealth based on your financial goals and the current market conditions. Call us today and lets talk about how you can max out your position as a buyer, a seller or as an owner to continue building your family’s wealth well into the future.

Committed to your success,

John Moran – CEO

The Smart Beach Investor | Keller Williams Realty AT THE BEACH TEAM

Keller Williams Realty – For Your Place at the Beach