Do you see an old woman or a young woman in the picture? What you see first is probably where you see yourself. According to a study, young people tend to see the young woman first, while older people tend to see the older woman. This analogy applies to our current real estate market. People who are in it for the long haul (10 years and longer) see a market with all kinds of potential upside. Those looking to get out in the short term (5 years or less) see a lot of risk and downside. And those in the 5 – 10 year time horizon are uncertain and unable to make a clear decision.

The Short Timers Reality

The most important factor in a successful real estate sale is perceived value. Buyers will pay almost any price as long as they believe there is value in the purchase. However, if you’re a short-timer, we are facing strong headwinds that make it hard to see value in the current market conditions. Let’s take a look at some of them.

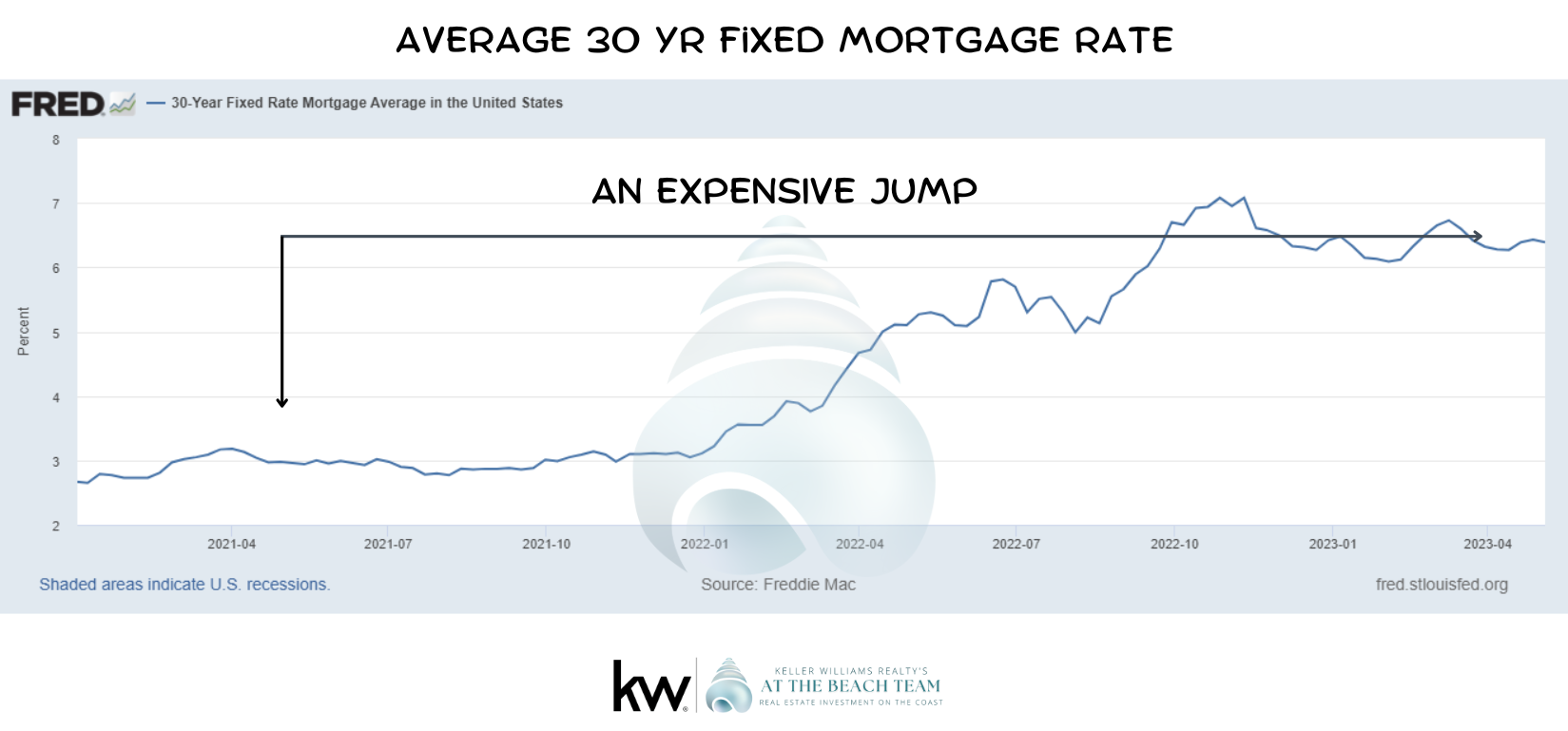

Cost of Money

Mortgage rates have risen sharply in the last 18 months, If you bought a property for $500,000 and put down 25% ($125,000) and financed the balance, your monthly mortgage payment would have been $2,582 at a rate of 2.96%. With today’s mortgage rate of 6.39%, that same property now has a monthly mortgage payment of $3,244, an increase of $662 every month. For investors, this means they have to cover an additional $8,000 per year to get the same return on investment. In a softening rental market, this is getting tougher.

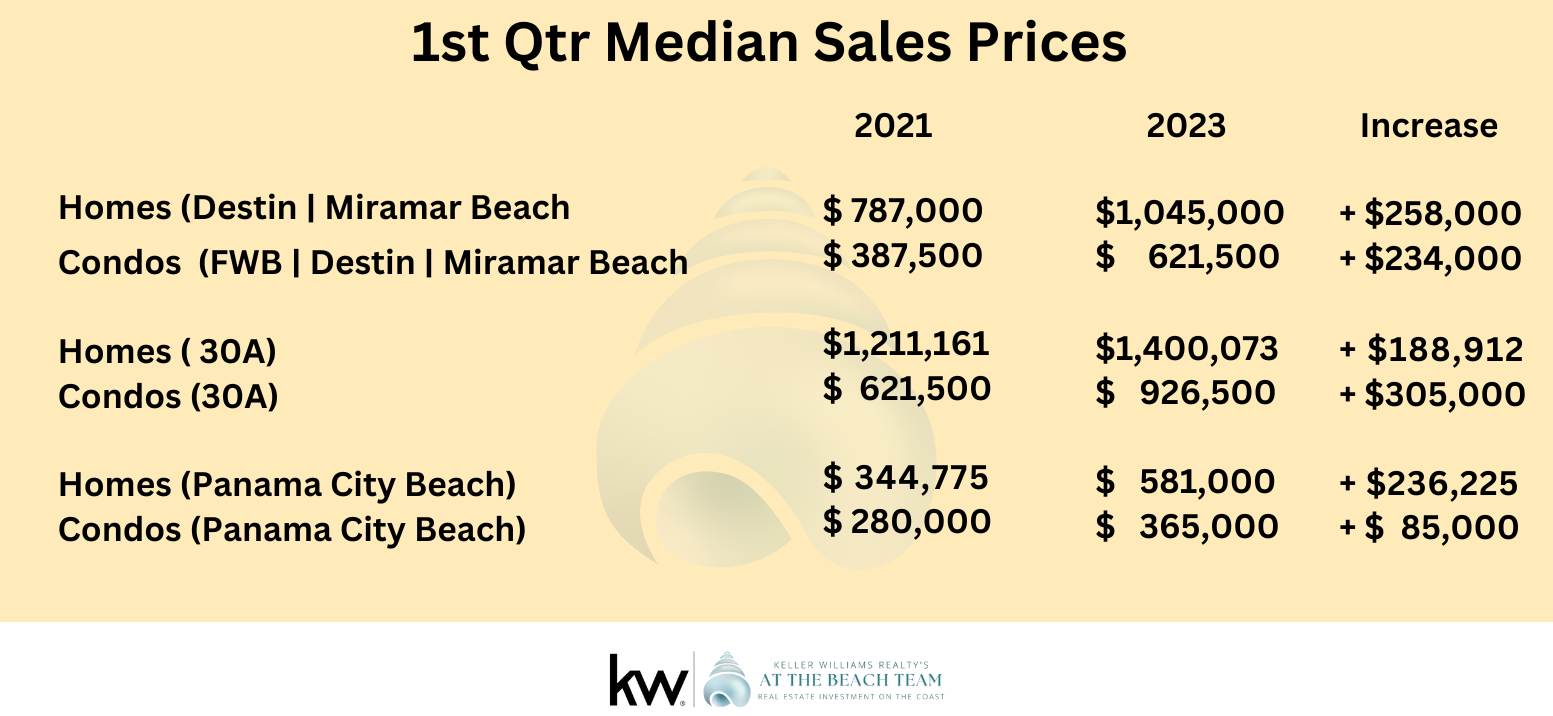

Sales Prices:

Sales prices have jumped dramatically over the last few years. See the table below how much each category has increased over the last two and a half years. While this is good news for sellers in the short term, it’s bad news for buyers and investors who can’t find value at these high prices and are sitting out, waiting for prices to drop.

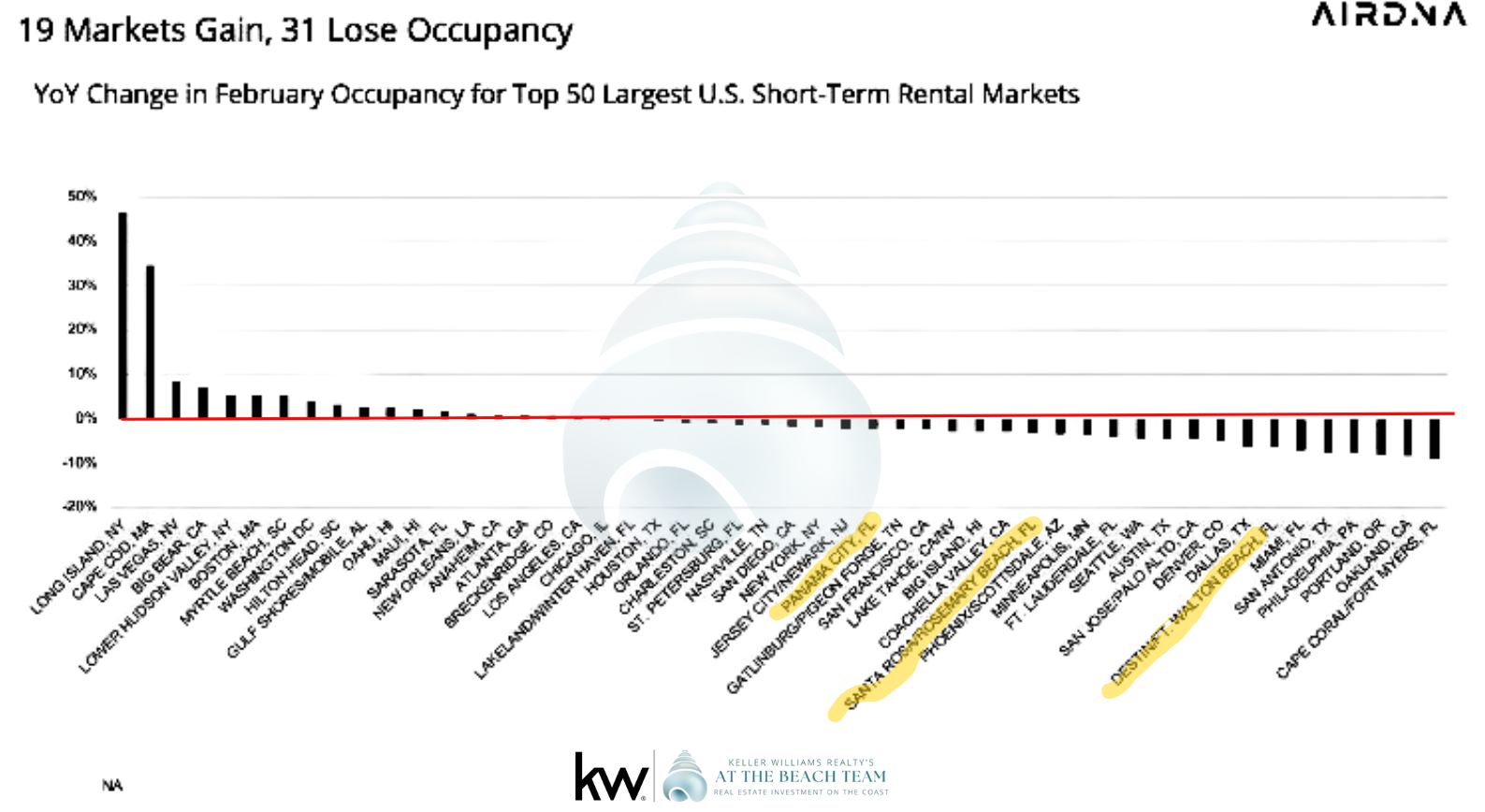

Rental Income:

Buyers often justify high sales prices if they can offset them with exceptional rental income. However, due to the current high inflation rates, increasing job insecurity, and an overall lack of consumer confidence, there is a softening of rental income across the Emerald Coast. AIRDNA, a company that tracks and analyses the short term rental market, recently published a chart showing showing how different areas are fairing in the current economy

Cost To Own:

Lastly, buyers can also justify high sales prices if they can cut their cost to own and operate the property and pocket the savings. But current market conditions are working against this premise as well. Insurance rates in Florida are predicted to jump at least 40% in 2023. This is in addition to the inflated costs of energy, maintenance, and everything else tied to homeownership.

What’s It All Mean?

For buyers to find value in the current market conditions, at least one of these has to happen:

- Mortgage rates have to come down.

- The price of the property has to come down.

- The rental income captured has to go up.

- The cost to own has to go down.

In the absence of any of these happening, it’s going to be hard for sellers to capture high sales prices. In addition, almost all indicators tell us prices will begin dropping. And when they do, it’s hard to say how far they will drop and how long it will take for them to come back to today’s level and beyond. So the best hedge for short-term owners is to sell quickly.

The Good News?

If you do want to or need to sell, inventory remains incredibly low, and prices are still very high. I would recommend that you sell quickly and let everyone else react to your sale, rather than the other way around. The upside? You may not get a really, really, high price… but you will still get a really good price.

Long-Term Owners

As we mentioned before, the best hedge against risk is to simply hold the property for a long time and focus on maximizing your rental income. Then, look at ways to use the equity you build up as an accelerator of your wealth.

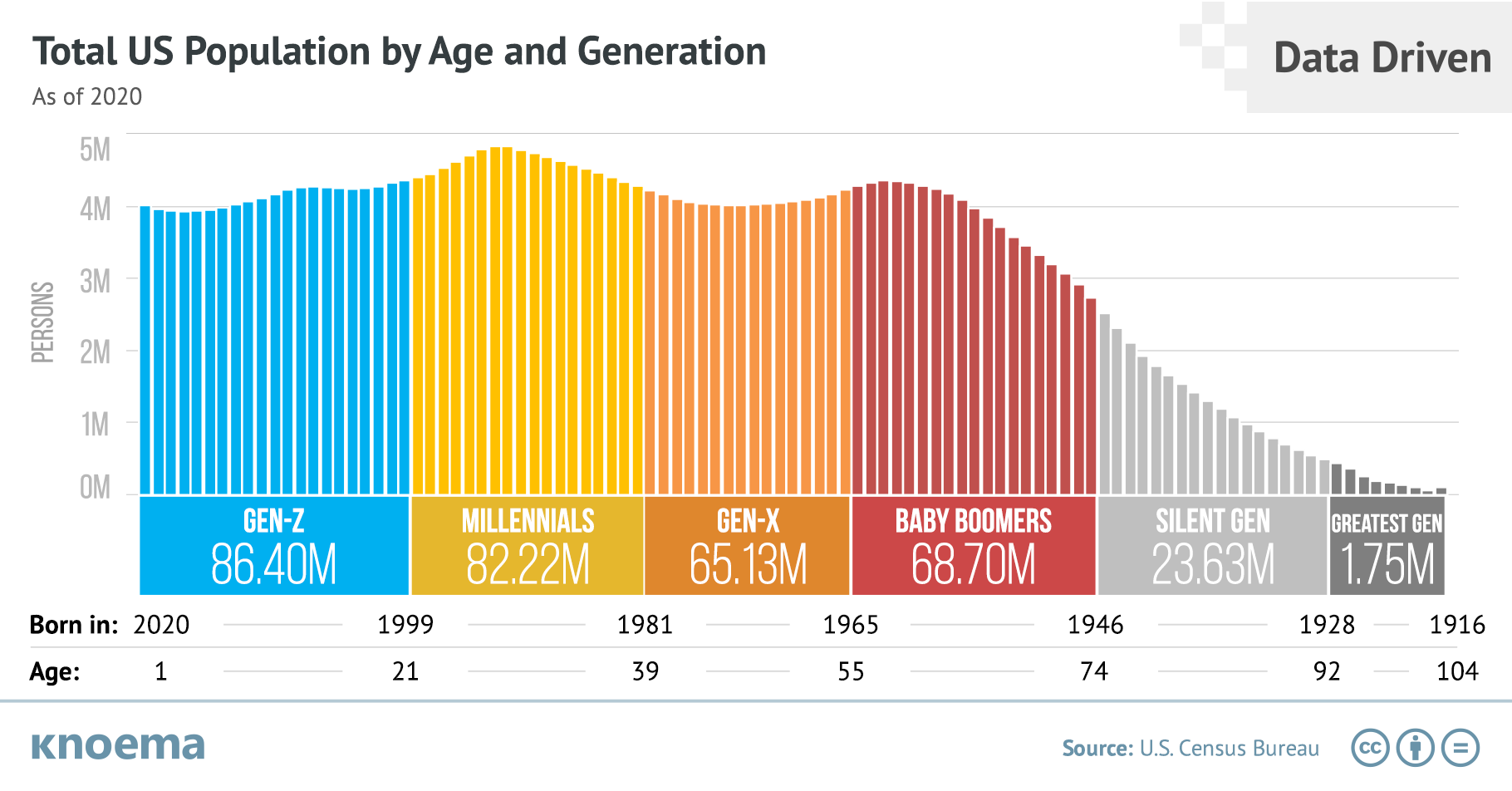

When you look at all the factors aligning in the coming years and how they relate to real estate in general and Florida specifically there is plenty of room for optimism and excitement when it comes to the future of real estate. Lets look at one of the brightest – US Population Demographics.

Real Estate Long-term Trend

Baby Boomers: We are seeing a large number of Baby Boomers (68.7 million) (55-75+/- years old) coming into their retirement years, and they have a lot of money to spend on homes and condos in Florida. They won’t all buy a place in Florida, but because of the weather and other factors, many will.

Gen-X: After the Baby Boomers, you have Gen-X (39-55 years old). There are fewer of them as the US saw a drop in population, but there are still a ton, and they are in the middle of their prime earning years, which means many of them will invest in second homes and rental properties at the beach.

Millennials: This is the biggest win for owners in for the long haul because there is a massive wave of people (82+ million) coming. Millennials are the 21-39-year-olds that everyone is always complaining about that they are lazy, just want to play video games and sleep on the coach. I don’t think that is true. Granted, they are “growing up” a little later than Gen X and Baby Boomers. What do I mean by that? They are living at home longer, getting married later, and buying homes at older ages. But, they do grow up, get married, and buy houses.

Gen Z: Right behind Millennials is Gen Z, which is another massive wave of people (86.4 million) who are younger than 20 years old. Their leading edge is now in college or just joining the workforce and will be in their earning cycle for years to come.

Watch for this wave to start showing up everywhere. If you sell wedding rings, own a restaurant, or perhaps you will want to sell your condo or house at the beach in 15 to 20 years, there will almost certainly be a massive demand for you.

In Sum

Short-Term: I am bearish on the short-term market conditions as the economy sorts itself out, the Fed gets inflation under control, and the downward cycle that we are currently experiencing or about to experience, runs its course. In other words, if you are a short-timer (planning on owning less than 5 years), get out now while prices are still pretty high.

Long Term: I’m bullish on the long-term market conditions because of the massive wave of people who are in their peak earning years and those who will be coming into them during the next 10-20 years. This will create a large buyer/investor pool for years to come.

What to do? What to do?

It depends on who you are… if you are a buy and holder (at least five years and probably longer right now) find a property that achieves your goal for owning and go get the best deal you can get knowing that over time you will likely win… and win big.

If you are an owner that plans to own for a long time (at least five years and probably longer right now) then sit back and ride this market out knowing that over time you will likely win… and win big.

If you a are a short time holder (five to seven years) our advice is to sell now and mitigate the risk of steep price drops. Note: Most indicators are pointing to price drops as some point… probably soon.

If you are buying to flip and grab quick cash… be very careful.

Bottom Line

We are wealth builders, so our goal (whether you are buying or selling) is to build or protect your wealth – based on your financial goals and the current market conditions. Call us today and lets talk about how you can max out your position as a buyer, a seller or as an owner to continue building your family’s wealth well into the future.

Committed to your success,

The Smart Beach Investor | Keller Williams Realty AT THE BEACH TEAM

Keller Williams Realty – For Your Place at the Beach