Speed and Gods

The other day I was driving on highway 10 between Destin and Tallahassee. The posted speed limit is 70 and I was cruising along at 80 but well within the flow of traffic when this big dark Escalade with heavily tinted windows comes flying up from behind me. It had to be going 95, maybe more, so fast that I reflexively checked my speedometer to see just how fast this maniac was going… and if I’m being honest, to see if perhaps I should juice my effort… just a bit. Feel me here? You know you’re going pretty fast but if that nut is going… that fast… maybe…

Anyway, about two minutes later I see the dancing blue and white lights of a highway patrol car up ahead, he had pulled the guy over and was giving him a speeding ticket. I tapped the breaks, coasted by the scene, and felt vindicated because this driver got pulled over for speeding… even though I was going ten miles an hour over the speed limit myself. What’s that old George Carlin joke… anyone going faster than you is a maniac and anyone going slower is an idiot? Well, that was this.

Anyway, here’s where it gets interesting… once you’re past the kerfuffle it’s decision-making time … do you thank the God of Speeding for the heads up and heed the warning to slow down because there is a dangerous curve ahead? Or do you crank up even faster because that maniac just took the cop out of play and now you should be able to really push it?

How does this tie into Zillow and our Real Estate Market?

The real estate market has been cruising along at a high rate of speed for a while now and keeping with the speeding analogy… the maniac flying up from behind is Zillow. Thanks to their iBuyer program Zillow stock skyrocketed, they bought up properties all over the place, and they were dominating the real estate world. Of course, as they were doing all this, the folks in the real estate world reacted by saying, “Look at those maniacs!” as they reflexively looked at their own businesses to see what they were missing and if Zillow knew something they didn’t.

Then, last week, Zillow got pulled over for going too fast and got hit with a massive speeding ticket. What does a massive speeding ticket look like? Well, according to an article in Forbes Magazine, Zillow reported third-quarter earnings in which it said it had lost a $339.2 million during the quarter, largely due to the faltering iBuyer program. Note, for the same period last year they reported a 39.6 million profit.

What is Zillow’s iBuyer Program?

The condensed version is Zillow was buying properties based on a proprietary algorithm that would predict a home’s future value six months out. Some of the properties were held without doing anything to them while with others they “forced appreciation” by fixing them up, always with the intent to sell them for the cost to buy and fix up plus the predicted increase in value. Again, all within six months.

That did not happen. The housing market slowed, supply chain issues occurred, labor became hard to find, all of which resulted in Zillow having to hold a ton of properties they could not sell – the iBuyer properties effectively became anchors pulling down their overall business. Initially Zillow said they were only going to pause the iBuyer program but later followed that up with a statement saying they had decided to wind it down completely. “It’s just challenging to predict future home prices in such a rapid and volatile market for home price appreciation,” said Jeremy Wacksman, Zillow’s chief operating officer. Yep, that is for sure.

The Big Question…

Back to our speeding analogy – Is Zillow running interference thus allowing the rest of us open highway, free of cops, such that we can really hit the gas again? In other words, the market is still solid and will continue to appreciate. Or… is Zillow getting pulled over a sign from the real estate gods telling everyone to slow down because there is a sharp curve ahead? This is a warning that the market is moderating and maybe even correcting.

Guidance

It’s hard to say which argument will prevail because one could make strong arguments both ways… and be right. Let’s look at some of the factors that led to Zillow getting pulled over for guidance. Zillow said it decided to shut down it’s iBuyer program after failing to accurately forecast home prices. Bottom line, they paid too much for homes and couldn’t flip them for a profit and now are stuck selling many of the properties at a loss.

What can we learn from Zillow?

Lesson 1. Zillow got away from investing and got into speculation. Smart investors who buy for positive cashflow such that they have the liquidity necessary to carry the property through a down market until prices come back to a level where it makes sense to sell. Speculators are essentially gamblers, people who buy based on predicted appreciation and they walk out onto a high wire without a net with each purchase. The wins can be big – no doubt – but the risk is big as well.

Lesson 2. Market’s go up and then they go down… but over time they always go up. This means if you are an investor you need to be smart and know your time horizons, you need to put an exit strategy in place such that if the market starts to turn you can get out without having to sell in a down market or having to wait until prices rebound, and you have to have a process in place to alert you to market changes.

Consider this: Smart investors have a predetermined plan before they buy a property – typically it comes down to two or three avenues:

- Time – smart investors buy knowing they are going to hold the property for a certain period of time. Examples are: They are holding until they retire at which time they will sell and use the money for something else. Some may simply own the property forever.

- Events – smart investors buy knowing they will hold the property until an event triggers the sale. Examples of this are College Tuition, weddings… things like this that are tied to dates or events.

- Price – smart investors buy knowing they are going to sell when the property values reaches a certain price. An example is someone who buys at $250,000 is going to hold the property until it’s worth $350,000 at which time they will sell.

How do you know your time horizons?

Investors watching their time horizons are a lot like surfers watching the swells for the next best wave. For those that know what to watch for or have people watching for them that can tell when a market has turned or is turning. This allows them to avoid big drops in the market and puts them in position to make sound buying or selling decisions that positively impact their wealth such that they continue to max out their financial goals.

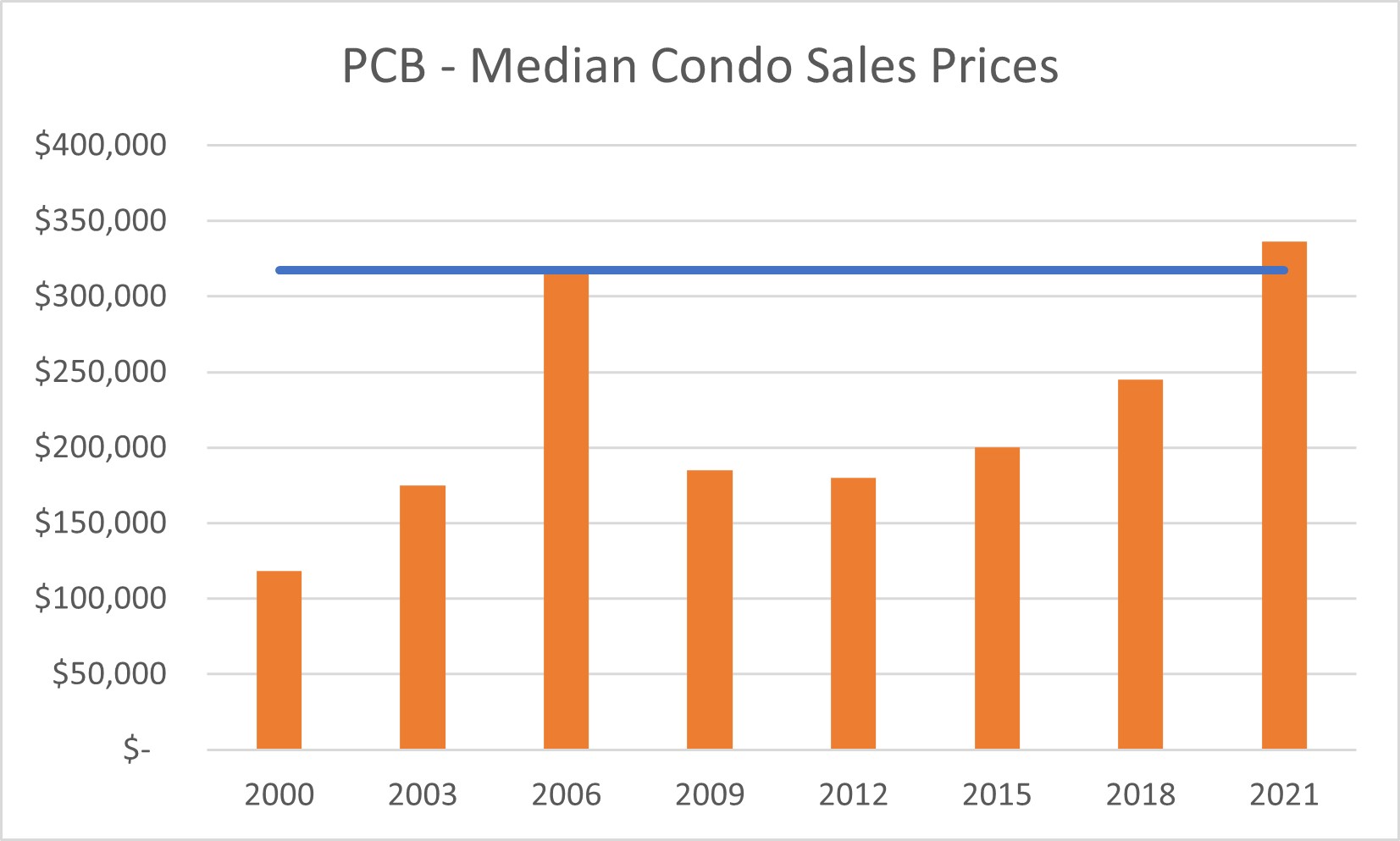

Look at the graphs below – the folks that bought in 2005, 2006 and 2007 (the top of the market) AND were short time holders – missed the wave or the market and really got hammered. The median sales price for both houses and condos on the Emerald Coast and Panama City Beach peaked in that three-year span and a lot of investors who bought in that time frame had to either hold the property for years until prices rebounded or sell at a loss.

Like Zillow a lot of “investors” back then were simply buying on appreciation, “flipping” properties for big gains, and then rolling them via a 1031 exchange into bigger, more expensive properties. They were not looking at the carrying costs, rental incomes or the fact they were buying with variable rate mortgages that could can would adjust in the future. They were speculating and not investing and – like Zillow – they got caught in a bad a spot when the market turned. Many were forced to short sell or had the bank foreclose on them.

Here’s the thing, and we preach this all the time to our clients, if the folks who bought at the top were long term holders or bought for cash flow and not just appreciation, they came out fine – in many cases – better than fine.

Panama City Beach: Looking at the Median Sales Prices for both Homes and Condos in Panama City Beach you will see that the peak to trough difference was even more pronounced.

What Should You Do?

We’re wealth builders so as it always is – our goal is to help you max out your position as a Seller or Buyer based on your financial goals and the current market conditions. With this in mind we recommend:

Long Term Owner

If you plan on owning for five years or more (longer the better) – do nothing, sit back, and watch the market go up or down. Either way, you will be able to ride out almost any cycle and then sell at the next high point. Note: If you are going to hold, we recommend that you do three things:

First: Max out your rental income. This will give you more money (passive income) and/or pay down your mortgage (create equity) and make it easier for us to help you sell it faster and for more money somewhere down the road when the time is right for you to sell.

Second: Max out your equity. If you have owned your investment property for a while you likely have a lot of equity in it. You can then leverage that equity to buy an additional investment property(s) that cashflow. This cashflow can then be used to pay off your previous investments. As Robert Kiyosaki, author of Rich Dad Poor Dad stresses, “Buy an asset to pay for a liability.”

Third: Max out your tax advantages for owning an investment property.

Short Term Owner

If you are not planning on owning for at least the next five years – sell now while we now prices are high and mitigate any risk of the market correcting, prices dropping and you sacrificing the equity you’ve built up.

Buyer – Will Be a Long Term Owner

Like we mentioned earlier, if you are going to buy and hold the property for at least five years – longer the better – then we recommend that you absolutely buy now while mortgage rates are low, rental demand is strong and getting stronger and prices are still relatively low (compared to future prices). Of course, if you are going to buy and own long term you are going to want to max out your rental income, Max out your equity and max out your tax advantages. Call us about how to max out these points – 850-654-3325.

Buyer – Short Term Flipper

If you are thinking about buying and then turning around and flipping the property… be careful. Prices have definitely jumped and had you bought a year ago and sold now you would have captured a great return… but… like we mentioned earlier, the market is in a bit of a pause right now. It certainly could take off again… but… it could also stay flat or correct. There are people who make flipping work so if that is your game, call us and we will be happy to help you find a deal.

Bottom Line

We were fortunate enough to not only have survived the last bubble we were able to thrive as we helped hundreds of our clients navigate those hard times. Now we are at a point where we’ve successfully assisted sellers and buyers close on almost 1,400 transactions over the years. And more than 230 already this year.

Always Know This:

Again, we are wealth builders, so our goal (whether you are buying or selling) is to get you the best deal possible – based on your financial goals and the current market conditions – call us today and lets talk about how you can max out your position as a buyer, a seller or as an owner to continue building your family’s wealth well into the future.

Committed to your success,

John Moran – CEO

The Smart Beach Investor

AT THE BEACH TEAM

Certified Luxury Home and Condo Marketing Specialists

Keller Williams Realty Emerald Coast

Gulf Breeze | Navarre Beach | Destin | 30A | Panama City Beach