Of course, there are always those folks who choose to take a different approach- the naysayers. These are the people who decide to paint their house even though Jim Cantori and his crew just rented an Airbnb up the road for the next 3 days so he can report “Live From The Storm!”

People, having owned, sold, and rented real estate here on the Emerald Coast for almost 20 years, I can tell you that there are signs everywhere telling us that a storm is blowing straight for our real estate market.

Why do I say this?

There are four key pillars that drive any real estate market, and what we are currently seeing serves as both a warning and a clear sign of trouble ahead.

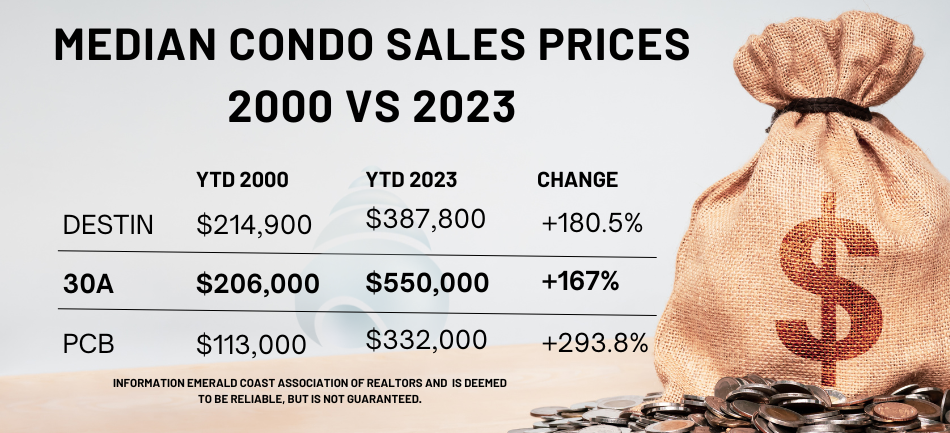

- Cost to buy real estate – Up

- Cost of borrowing (mortgage rate) – Up

- Cost to own and maintain real estate – Up

- Rental Income potential. Down

Our real estate market is experiencing a downturn on all four pillars, signaling a storm is approaching. Let’s take a closer look.

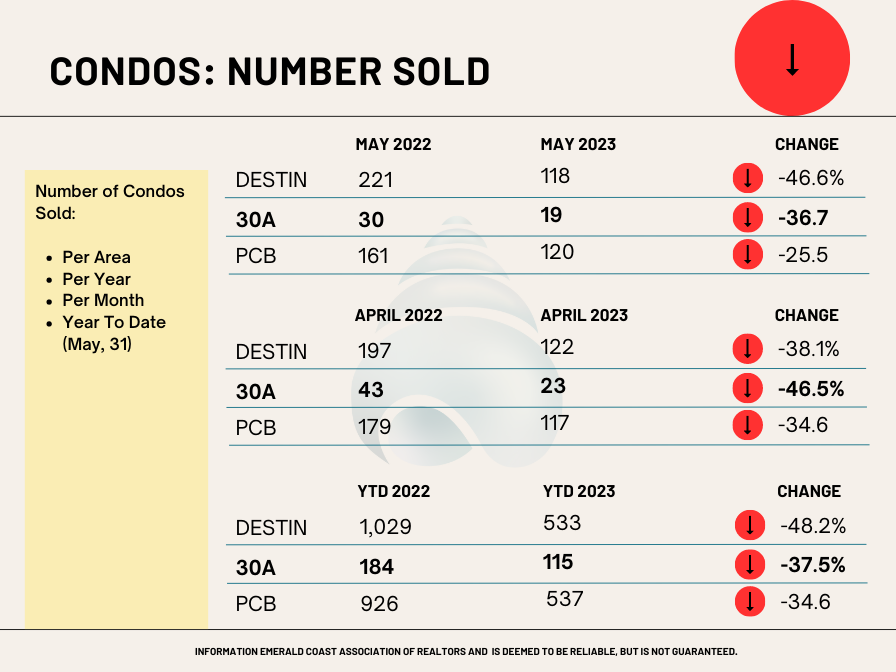

Take Away?

Buyers and investors are not finding value in today’s market place due to high prices, combined with the current cost of borrowing (mortgage rates) and the over all expenses of owning a property. Consequently, many buyers and investors are opting to wait on the sidelines. This trend is evident in the significant decline year over year across all three geographic areas of our market.

Prediction: Condo Prices are likely to come down across all three geographic areas.

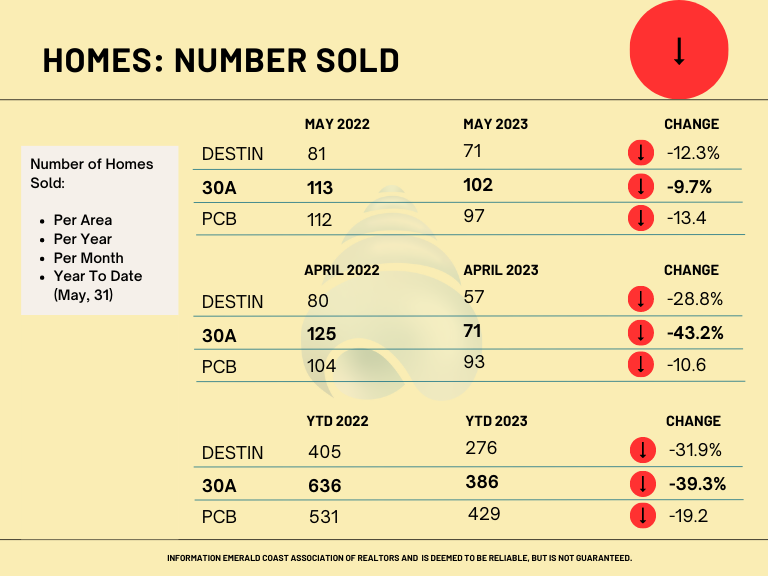

Take Away

Again, buyers and investors are looking at purchase prices, cost of money (mortgage rates) and then the cost to own and maintain the house and as a result, they are choosing not to buy right now.

Prediction: Home prices will drop across all three geographic areas. .

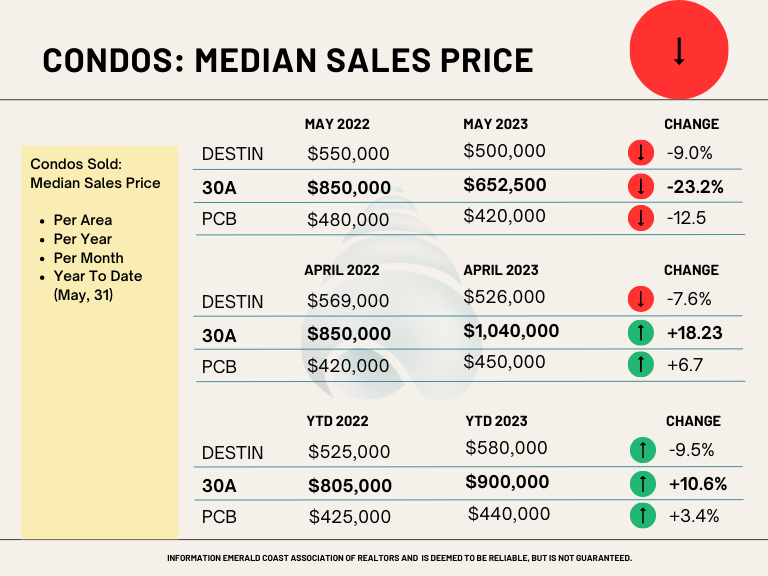

Take Away

It looks like May is when prices broke for condos across the board. The big three: Rising mortgage rates, escalating operating costs, and softening rental income is finally impacting sales prices.

Prediction: Look for prices to continue dropping until affordability starts to show up again.

Take Away

Like with condos, I think we will look back on May of 2023 as when the dam broke and prices started to give way. How far they drop and for how long they stay down remains to be seen.

Prediction: Prices will continue to drop unless some unforeseen force appears and changes the value / cost dynamic.

What to do? What to do?

The difference between risk and rich sometimes comes down to a roll of the dice, but it doesn’t have to. Knowledge, experience and patience almost always favors investors who can lean heavy on these attributes. As an answer to the the “What should you do question?” I would tell you that It depends on your plans… if you are planning to a buy and hold (at least five years and probably longer right now) find a property that achieves your goal for owning and go get the best deal you can get knowing that over time you will likely crush it.

If you are an owner that plans to own for a long time (at least five years and probably longer right now) then sit back and ride this market out knowing that over time you will likely crush the real estate investing game.

Not In It For The Long Haul

If you a are a short time holder (five to seven years) our advice is to sell now and mitigate the risk of steep price drops. My experience has been, once buyers understand that prices are dropping and will likely continue to drop they stop buying and wait to see how low prices will go. As part of the cycle, sellers who are vulnerable inevitably succumb to the pressure and sell lower than they would like. All of this serves to push prices down further and for longer.

If you are buying to flip and grab quick cash… be very careful.

Bottom Line

We are wealth builders, so our goal (whether you are buying or selling) is to build or protect your wealth – based on your financial goals and the current market conditions. Call us today and lets talk about how you can max out your position as a buyer, a seller or as an owner to continue building your family’s wealth well into the future.

Committed to your success,

John Moran – CEO The Smart Beach Investor |

Keller Williams Realty AT THE BEACH TEAM

We Make Real Estate Easy.

Note: The artist for this months header is Tom Judd