Is timing more important than location when it comes to real estate investing and making money? Everyone talks about location… location… location… when it comes to real estate, and that is true. But I would argue that what is even more important, or just as important as location, is timing. Think about it. You can buy a property in a not-so-great area and sell for a huge gain in a hot market because of timing. Or you can buy a property in a great area and struggle to sell or rent if the market cools because of timing.

Timing Examples

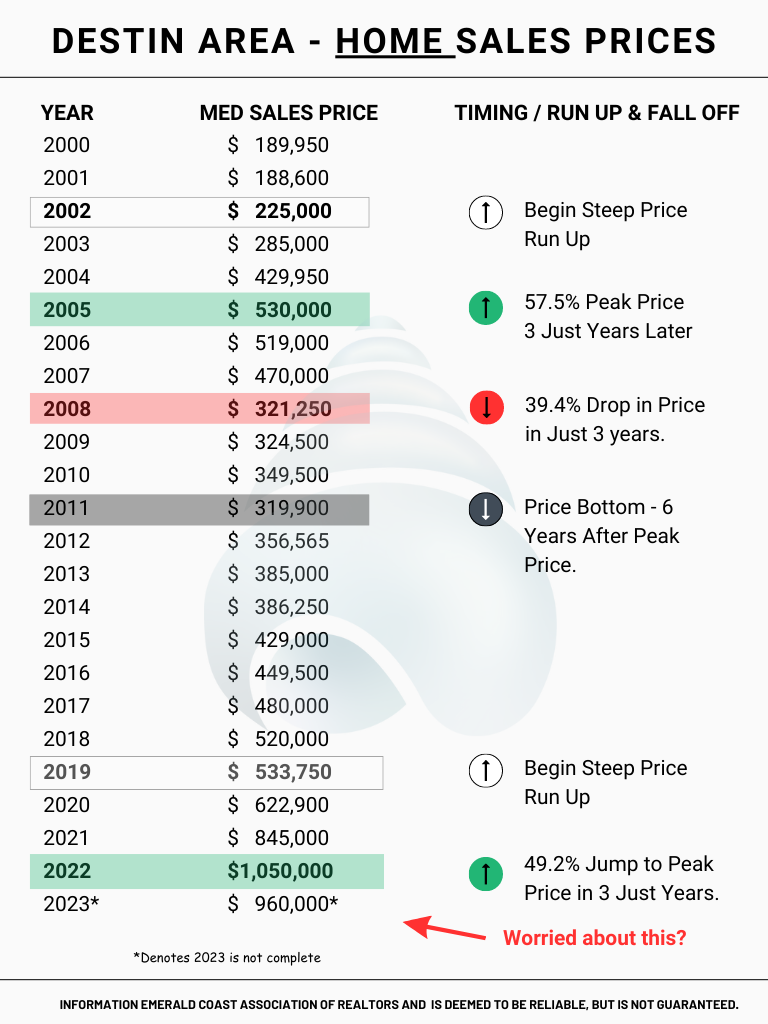

If you bought a house in the Destin Area (a great location) in 2003 (great timing), you would have paid a median sales price of $285,000 for it. Had you waited two years, until 2005, you would have paid a median sales price of $530,000 (not-so-great timing). That is a 46.22% jump in just two years. Let’s keep going. Instead of selling in 2005, you decide to wait just one year until 2006? Bad plan. Prices dropped from $530,000 to $519,000. What if you waited two years? Worse, prices kept dropping to $470,000 in 2007. Three years? Even worse, prices kept dropping to $321,250 in 2008. Which means they went from $530,000 in 2005 to $321,250 in 2008—a 39.4% drop in three years. Timing kills.

However, had you held onto that property until 2022 when the median price peaked at $1,050,000, you would have seen a 49.5% gain from that high price in 2002. In this case, you had killer timing in a good way. Here’s a more recent data set: still Destin, still houses. If you would have bought three years ago, in 2019, the median price would have been $533,750. The next year, 2020, it was up to $622,900. Then in 2021, it was up to $845,000. So just three years later, in 2022, the median price for a house in Destin was $1,050,000. In other words, 49.2% more! Timing matters.

Let’s take a look at timing across the Emerald Coast and see what takeaways we can use to make good timing decisions.”

Take Away?

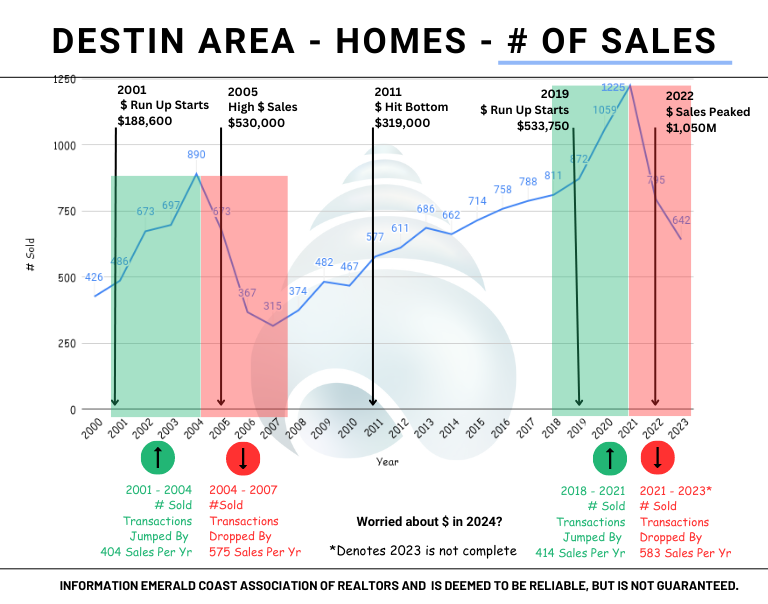

Steep run-ups in price have been followed by steep drop-offs in Destin Area home prices. We have been in a period of steep price run-up, so you should be looking out for signs of a fall-off. We are starting to see this effect with Destin Area houses, and the median sales prices have fallen so far in 2023 by almost $100,000! Prediction: Look for further price declines.

Take Away

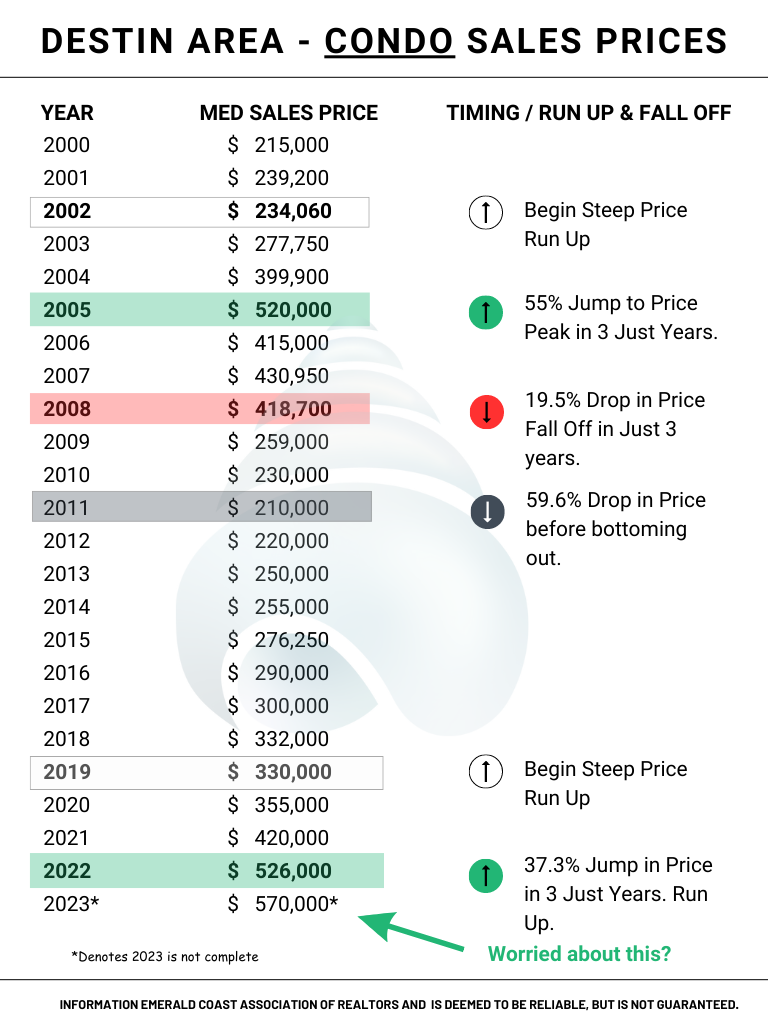

Again, the early 2000s showed us how a steep increase in the price of condos precipitated a deep drop in prices. Now we are experiencing another steep jump in prices, but how long it lasts and how high it goes remains to be seen. One thing we know from history is that these spikes don’t last forever, and the fall-off can be steep. Prediction: Destin Area condo prices will drop in the coming months.

Take Away

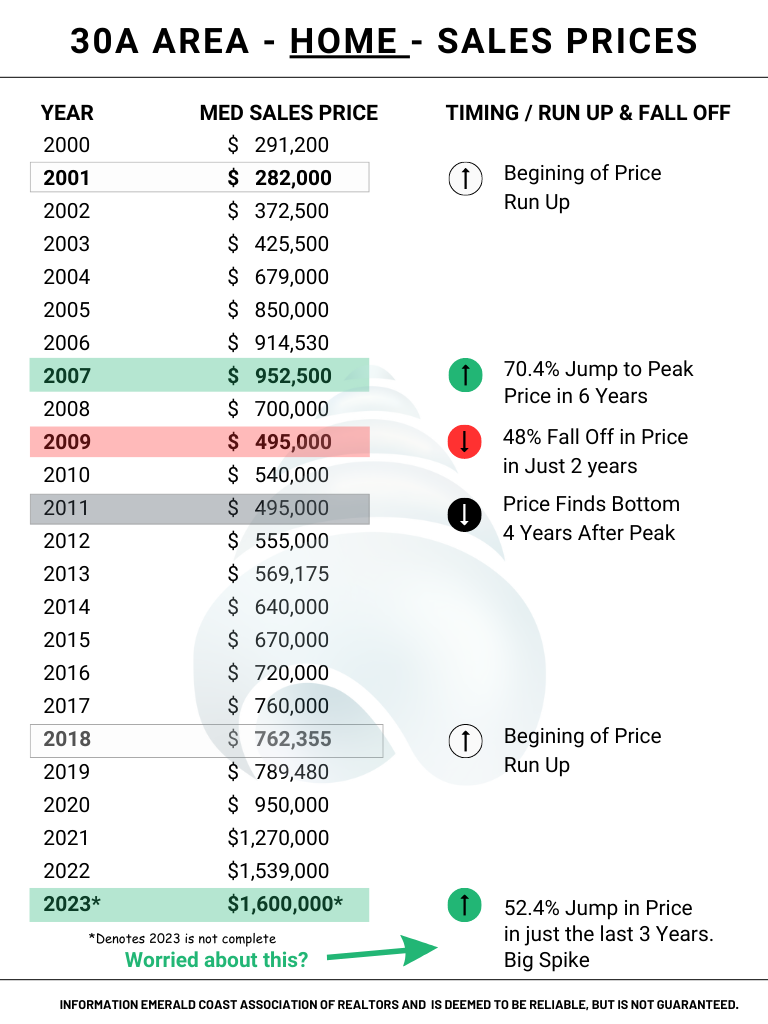

30A home sales prices jumped dramatically in the early 2000s, only to fall back hard over a two-year period from 2007 to 2009. Now we find ourselves looking at another huge run-up in 30A home prices, with a 49% increase over just three years. As we have seen in the past, for every steep run-up, there is a hard drop-off to follow. Be very careful if you plan to sell in the next several years; you may end up having to ride out a downturn. Prediction: Look for prices of 30A homes to drop.

Take Away

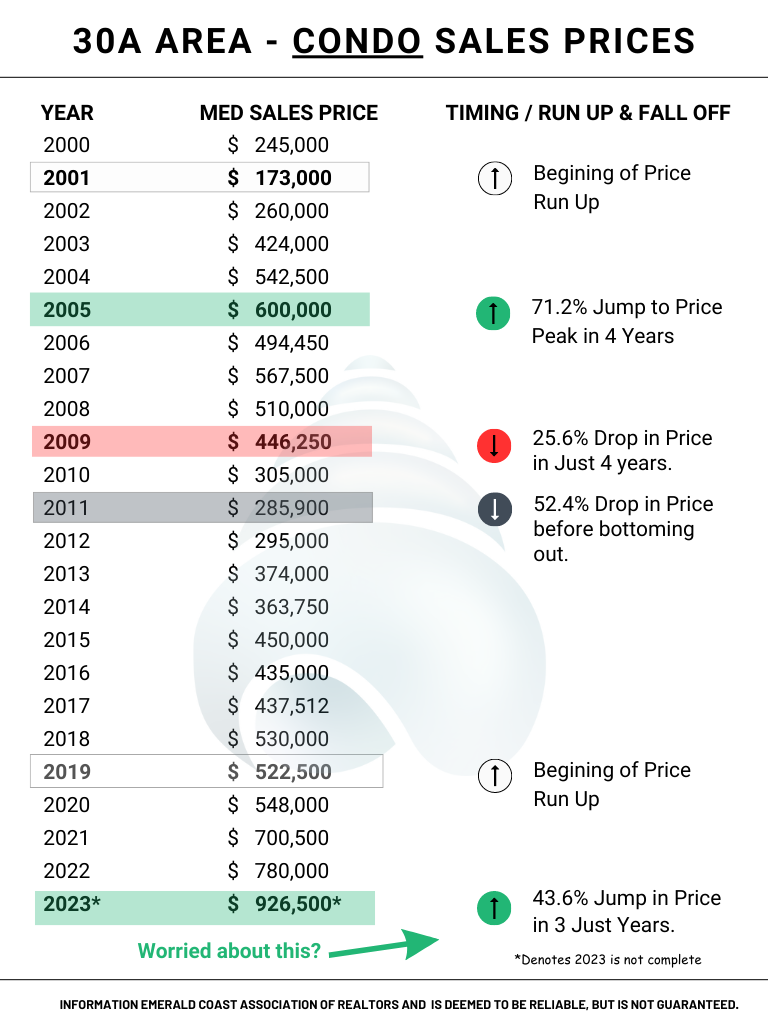

Look at the massive run-up in 30A condo prices back in the early 2000s; it’s impressive how far and how fast they climbed. Then look at how far and how fast they fell; that was also very impressive. Now, look at the massive run-up in 30A condo prices over the last few years; it’s impressive how far and how fast they’ve climbed. Sound familiar? Prediction: Look for 30A condo prices to experience a fall-off. How far and how fast remains to be seen. If you don’t plan on owning for a long time, be very careful.

Take Away

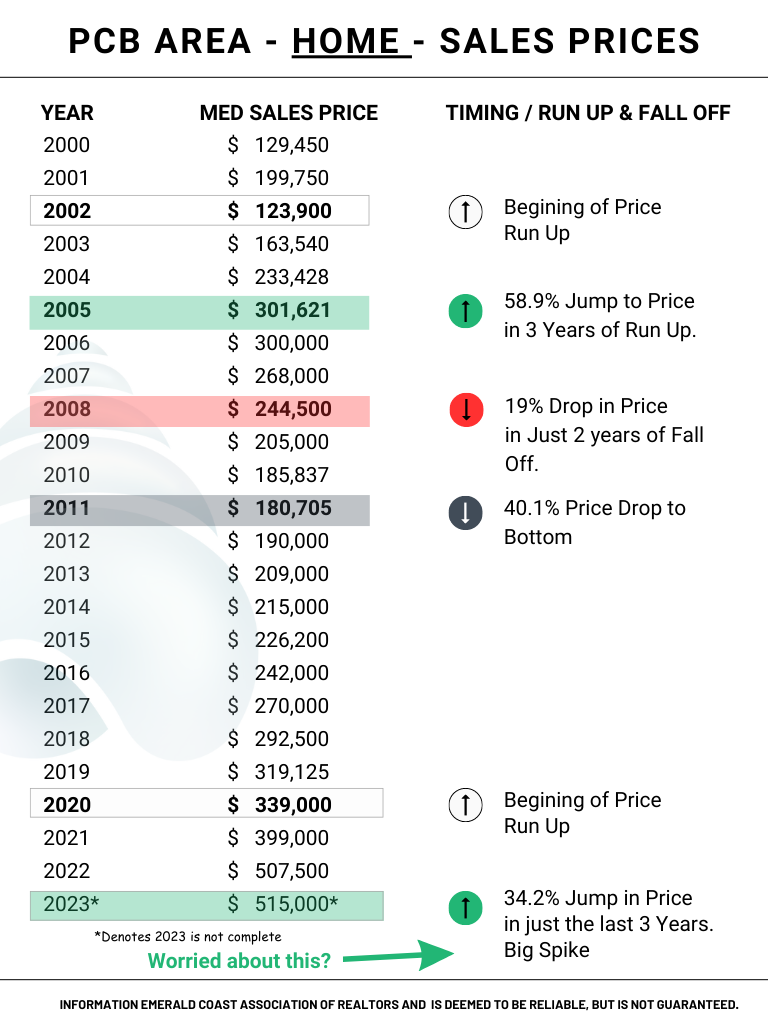

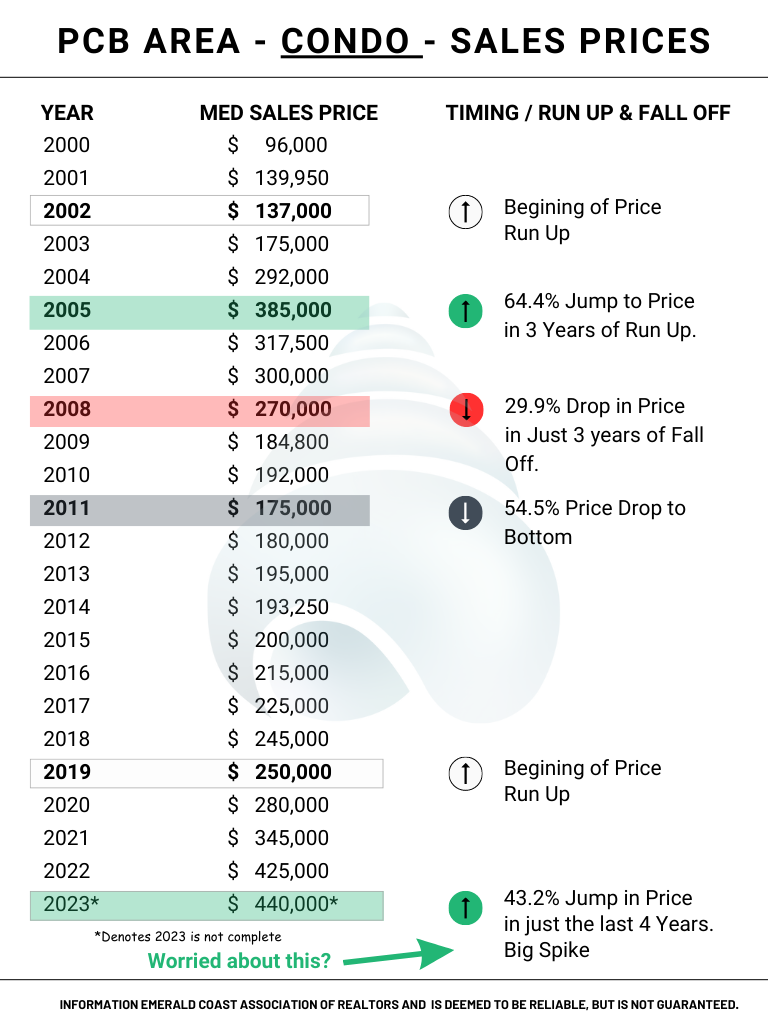

Like the rest of the Emerald Coast, Panama City home prices spiked in the early 2000s and then saw a subsequent fall. In 2020, we witnessed another spike in Panama City Beach home prices, and they are still on the rise. For how long? It’s hard to say, but as the saying goes, ‘What goes up must come down.’ Prediction: Look for prices of Panama City Beach homes to drop in the coming months.

Take Away

Panama City Beach condo prices took off from 2002 to 2005, jumping 64.4%. Like the rest of the Emerald Coast, Panama City Beach condo prices then took a nosedive, dropping 54.5% from the peak. In 2019, Panama City Beach condo prices took off again, jumping 43.2% as of today. Whether they will continue their run-up or start dropping remains to be seen. Prediction: Look for prices of Panama City Beach condos to start falling in the coming months.

When is the Timing Going to Change?

Wouldn’t it be nice if we had some kind of warning that told us when the market is about to change, so we could better time our buys and sells? Well, we do. Monitoring the number of sales in a category can provide valuable insights into market shifts – generally speaking.

Watch for Spikes in the Number of Sales

Pay attention to steep spikes in the number of transactions per year, whether they are going up or down, over a 2 to 3-year period as your guide. If the market has been experiencing a dramatic spike (200+ transactions over 2 years) either up or down, get ready. Change is coming, and it’s likely to be significant.

Take Away

From 2001 until 2004, the number of home sales in Destin skyrocketed, but then stalled and started falling, declining even more than they had climbed. In 2018, the number of Destin home sales began jumping, similar to the early 2000s, and peaked in 2022. Just like in the early 2000s, the number of sales has started dropping dramatically and continues to decline. If history is any indicator, prices will follow suit. Prediction: Look for prices of Destin area homes to drop.

Take Away

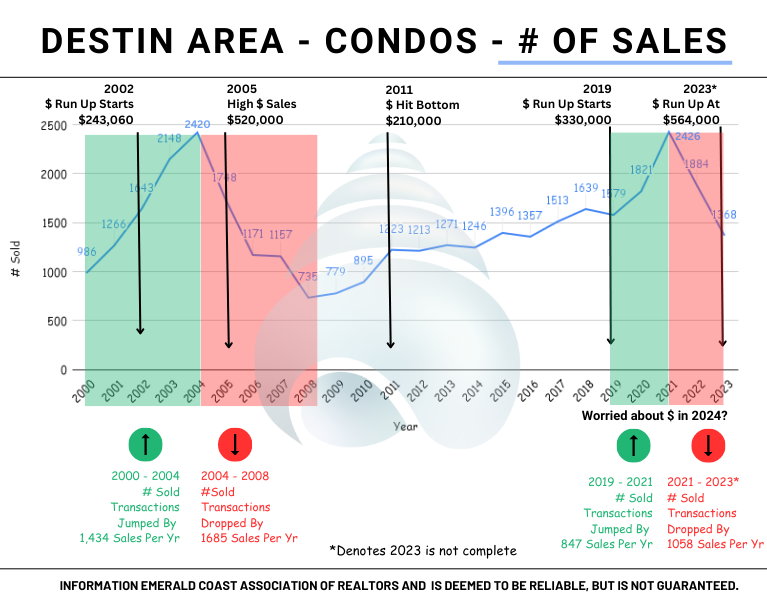

Destin Area condo sales started climbing earnestly in 2000 and didn’t look down until 2004, after they had jumped from 986 condos sold in 2000 to 2,420 in 2004. But down they did go. In 2004, the number of condos sold went into freefall, bottoming out in 2008 with 1,685 fewer transactions than the peak just four years earlier. Now we are observing a similar trend, with the number of condos sold experiencing a 35% jump between 2019 and 2021. As expected, once prices peaked, they started dropping, and it is anticipated that they will be off by approximately 43.7%+/- from the peak by the end of the year. If history serves as any guide, it’s going to be very tough for prices to hold up in the coming months and years. Prediction: Look for prices of Destin Area condos to start dropping..

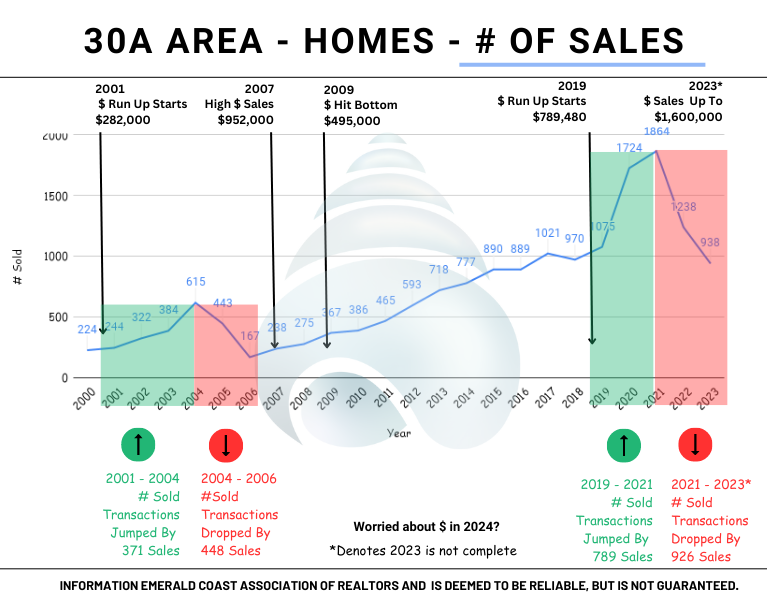

Take Away

30A also witnessed significant jumps in the number of homes sold back in the early 2000s, only to be immediately followed by even greater drops. Once again, we are now observing a similar trend with the number of 30A home sales, increasing from 970 in 2018 to 1,864 in 2021. However, since 2021, we have seen a sharp decline in the number of 30A home sales, dropping to approximately 938 in 2023. While we will have to wait and see how the year ends, it’s safe to say that the number will be lower. Prediction: Look for prices of 30A homes to start softening and possibly experience a significant drop.

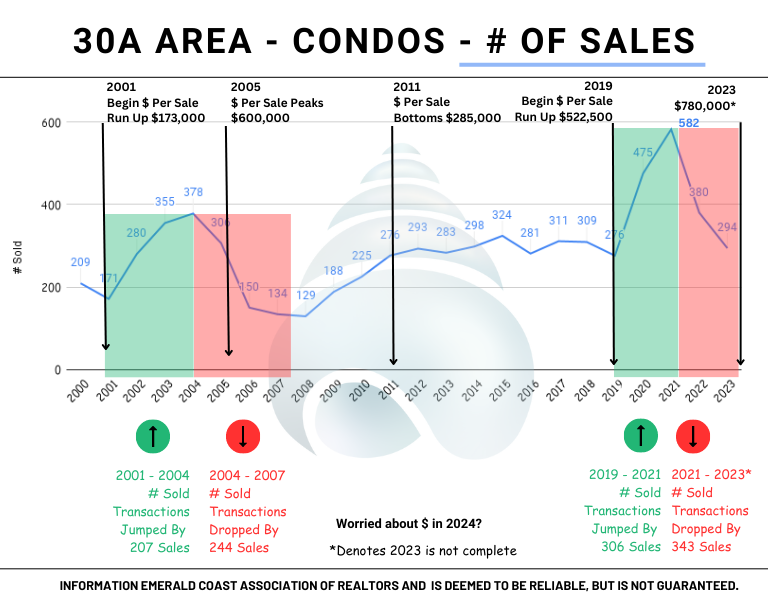

Take Away

30A condo sales jumped way up between 2001 and 2004 and then tanked right after they peaked. Now it appears they are doing it again having jumped dramatically from 2019 to 2021 before falling back each year since the high. Prediction: Look for prices of 30A homes start to soften and perhaps see a significant drop.

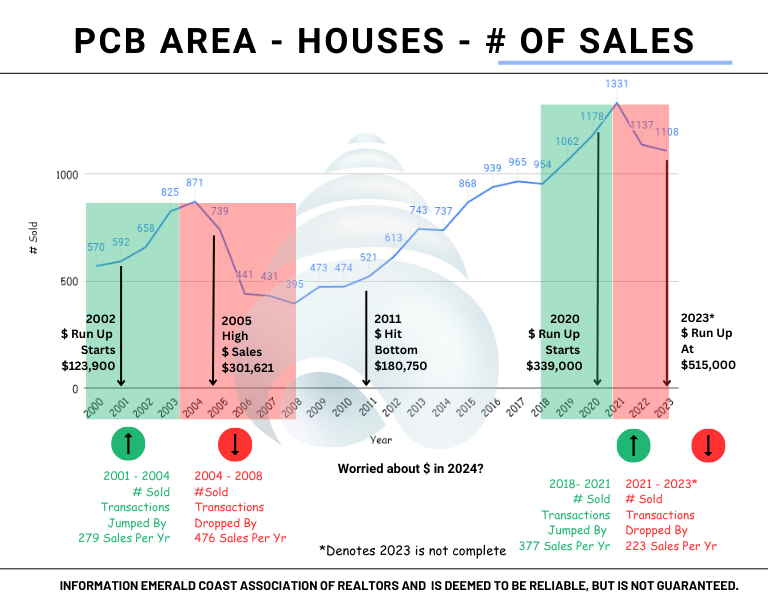

Take Away

The number of home sales in Panama City Beach followed the same trend lines as the rest of the Emerald Coast back in the early 2000s, with a spike in sales between 2001 and 2004. Prices followed suit, with a lag of about a year or so, but they certainly rose as well. Similar to the rest of the Emerald Coast, the number of transactions in Panama City Beach experienced a significant decline from 2004 through 2008, and once again, prices followed suit, reaching a bottom in 2011. We are currently witnessing a similar trend, with the number of sales peaking in 2021, and now in the midst of a decline. Prediction: Look for prices of Panama City Beach homes to start dropping later this year or in the first part of 2024.

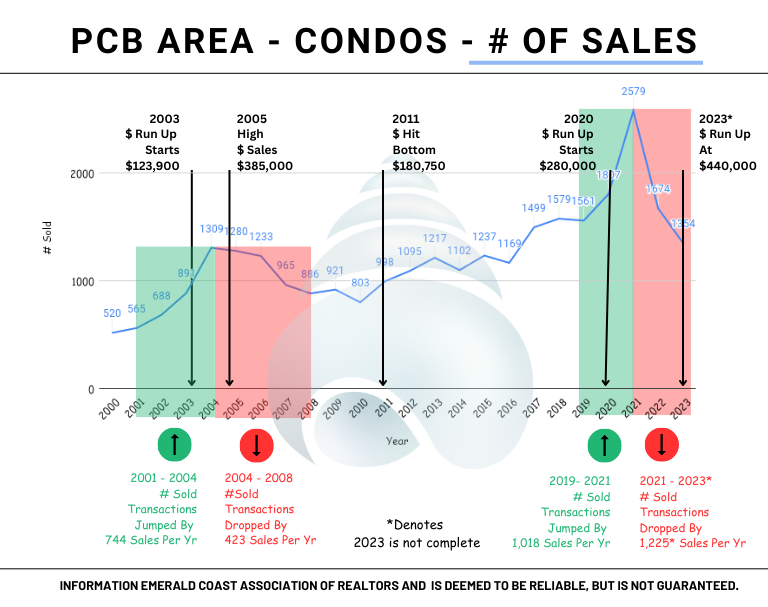

Take Away

The number of condo sales in Panama City Beach took a steep upturn in the early 2000s, jumping from 565 transactions per year to 1,309. It was a dramatic increase, and prices followed suit. The interesting thing about the Panama City Beach condo market is that it took some time for the number of transactions to decline, and when it did, it followed a more gradual path. However, the old pattern has returned with a massive run-up starting in 2019 and peaking in 2021. As is the case with most run-ups, a decline is to be expected, and it has already appeared in Panama City Beach, with the number of transactions dropping from 2,579 in 2021 to an expected 1,354 this year. Prediction: Look for prices of Panama City Beach condos to start following the decline in the number of transactions.

Take Away

Always buy the best location you can afford because that location will provide you with insurance. What does that mean? If you have to sell in a bad market (timing), you have a better chance of getting a ‘good’ price. Similarly, if you are renting in a tight market (timing), you have a better chance of staying rented compared to having a less desirable location. Then, simply watch what’s going on and be prepared to cash out or trade up when the market starts running (timing).

Not In It For The Long Haul

If you a are a short time holder (five to seven years) our advice is to sell now and mitigate the risk of steep price drops. My experience has been, once buyers understand that prices are dropping and will likely continue to drop they stop buying and wait to see how low prices will go. As part of the cycle, sellers who are vulnerable inevitably succumb to the pressure and sell lower than they would like. All of this serves to push prices down further and for longer.

If you are buying to flip and grab quick cash… be very careful.

Bottom Line

We are wealth builders, so our goal (whether you are buying or selling) is to build or protect your wealth – based on your financial goals and the current market conditions. Call us today and lets talk about how you can max out your position as a buyer, a seller or as an owner to continue building your family’s wealth well into the future.

Committed to your success, John Moran – CEO The Smart Beach Investor | Keller Williams Realty AT THE BEACH TEAM We Make Real Estate Easy.