It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.” Mark Twain

There is so much talk about how supply and demand are the two elephants in the room when it comes to projecting real estate market trends and not far behind them is mortgage rates. I would put another and perhaps an even larger influence in that group as well… security. How secure do people feel about their future? Are they confident in their jobs, incomes, and opportunities to “move up”? If they are, they will have no problem spending money to rent a place at the beach and some will take the next step and actually buy a beach house or condo – even if the price is high or the mortgage rate is high.

Don’t believe me? Let’s take a look at some of the elephants (expectations) and results.

Supply

Everyone knows when supply goes up and buyers have more condos and houses to choose from (competition), prices should go down as sellers find themselves competing with other sellers to capture a buyer before they move to another property. Right?

Mortgage Rates

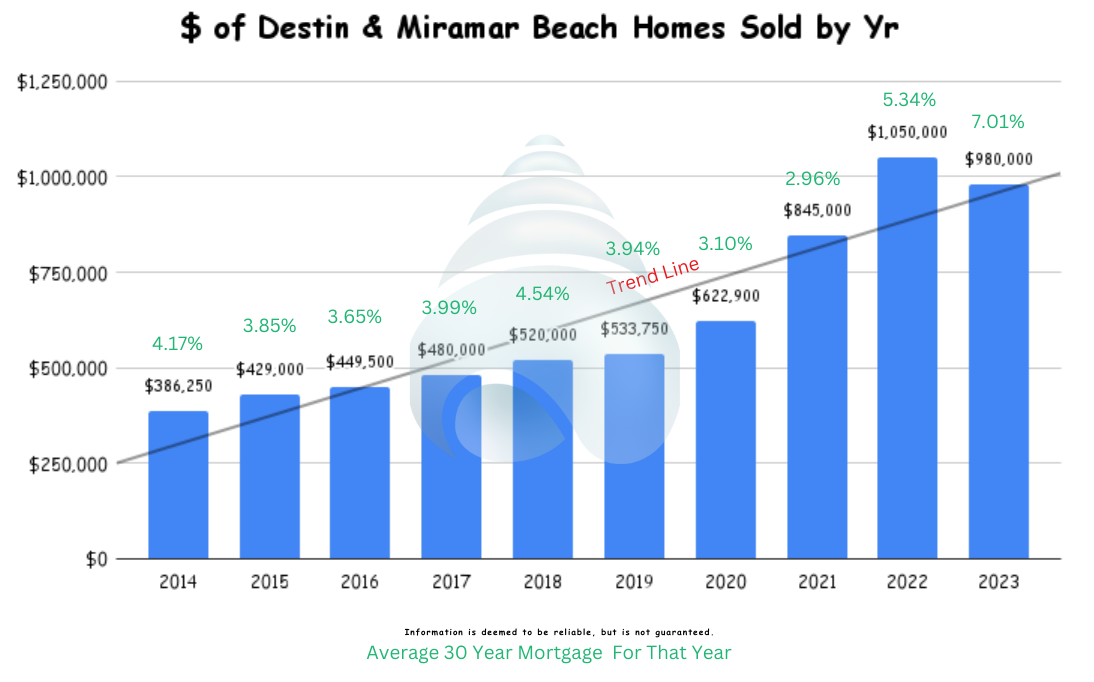

When mortgage rates go up the cost to borrow money gets prohibitive and buyers stop buying because affordability goes away. For affordability to come back, sellers have to lower their prices, mortgage rates have to come down, or both. That means when mortgage rates went up in 2021, 2022 & 2023 prices came down. Right? Applying that reasoning, when the Fed drops rates in 2024, surely prices will go up as more buyers can afford to pay more money for real estate. Right?

Let’s take a look at the last 10 years.

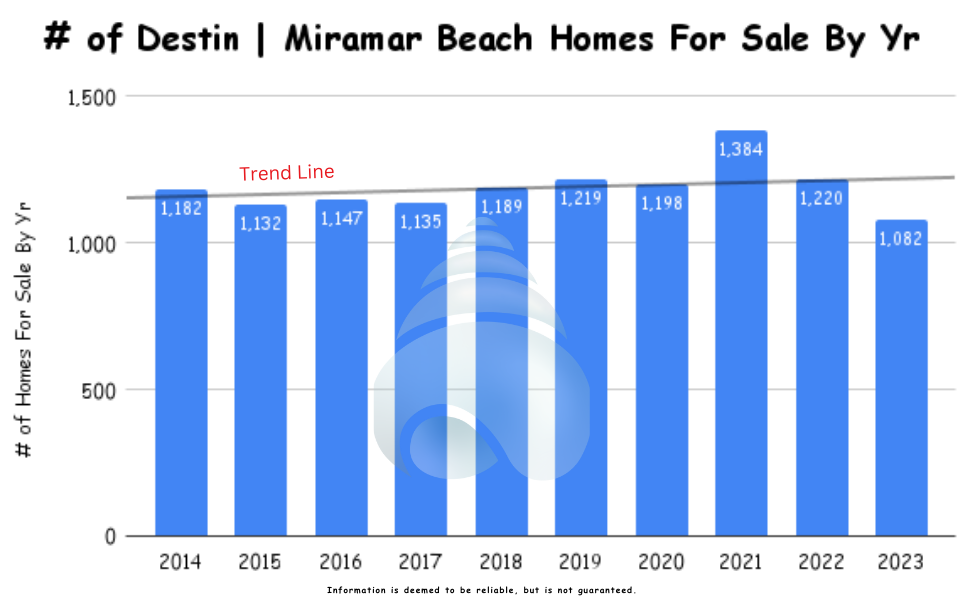

Supply of Destin | Miramar Beach Homes For Sale

Based on supply and demand principles the prices of Destin homes for sale should have decreased in 2021 as supply spiked and then started climbing again in 2022 and 2023 as supply dropped.

The prevailing wisdom with regard to mortgage is, when rates go down buyers can spend more money which should drive prices up. When mortgage rates go up, buyers can’t afford to buy and that should drive prices down.

Result of Supply and Mortgage Rates of the Last 10 Years?

It doesn’t seem like supply or mortgage rates have had any impact on sales prices. At least not until 2023. Is this simply a long lag effect?

Before we look at what I think the real elephant in the room is, let’s see what impact supply and mortgage rates have had on condos and homes on 30A and in Panama City Beach.

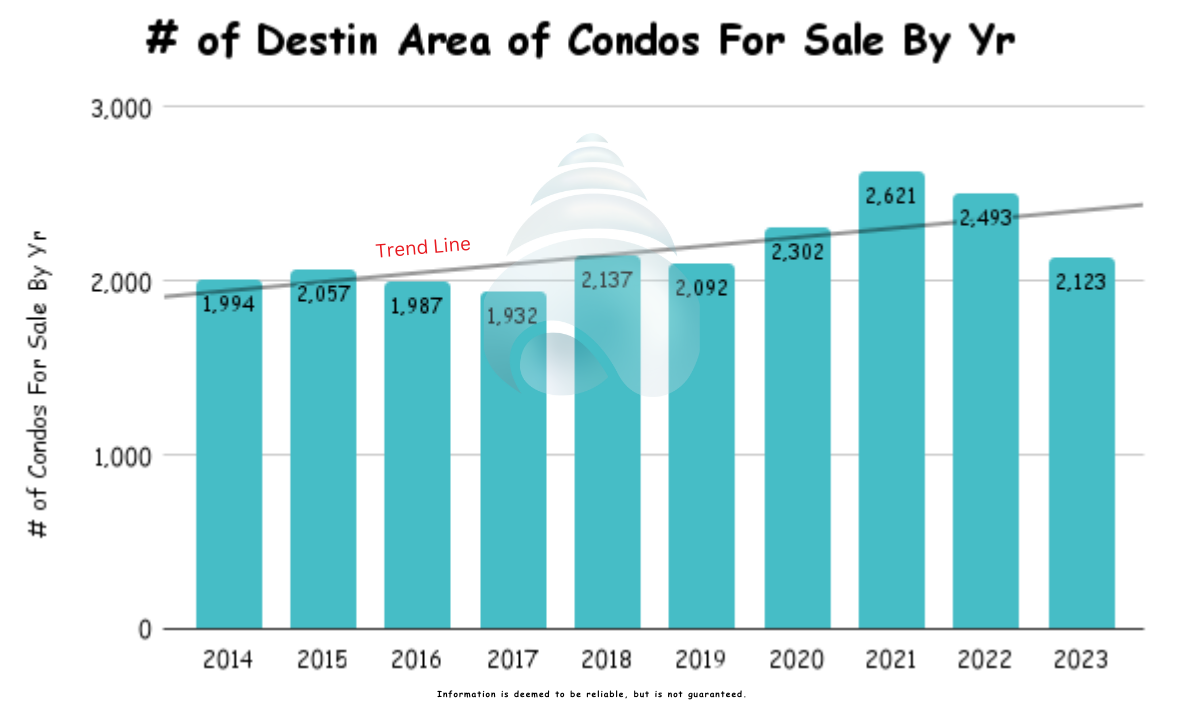

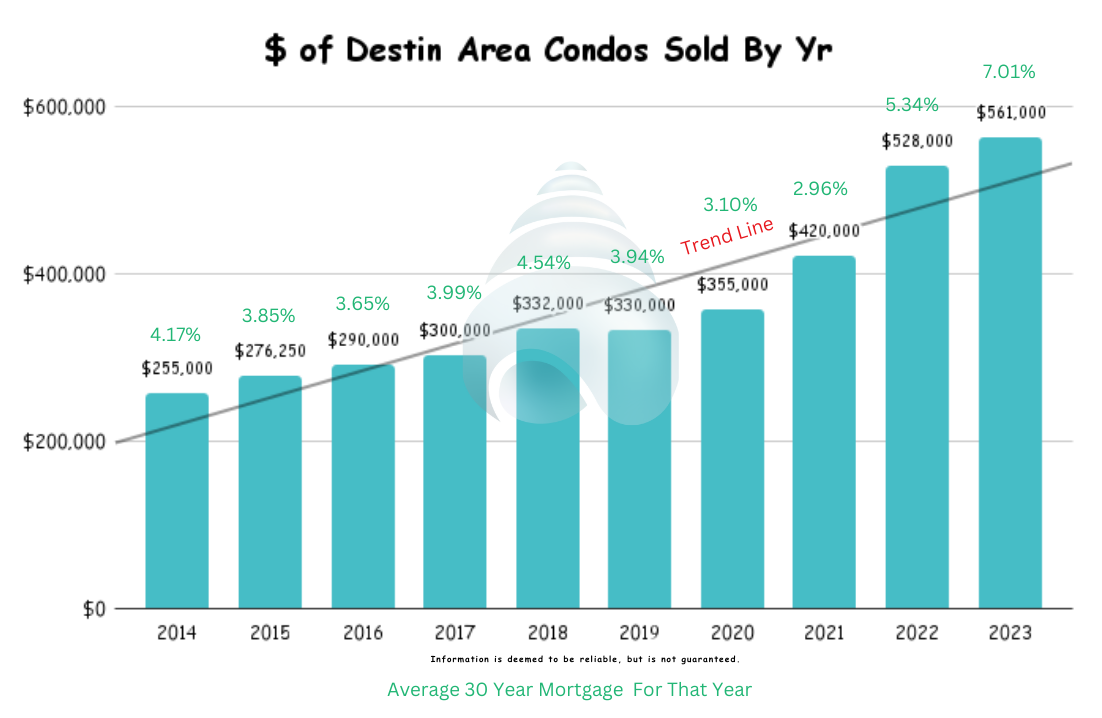

Destin | Ft. Walton Beach | Miramar Beach Condos

How about condos in the Destin Area, did the same thing happen in them?

Supply bounced around a bit over the last 10 years but it clearly spiked in 2020 and 2021 before dropping in 2022 and 2023. This means prices should have been somewhat flat, dropping as supply increased in 2020 & 2021 before increasing in 2022 and 2023.

Price Reaction?

Prices are not following conventional wisdom, by a long shot. Prices for Destin Area condos have clearly climbed and continue to climb regardless of supply.

Mortgage Rate Reaction?

Again, prices are not following conventional wisdom and dropping when rates are high, climbing when rates are low. They are simply – climbing.

Let’s look at 30A and Panama City Beach before we look at why this result occurred.

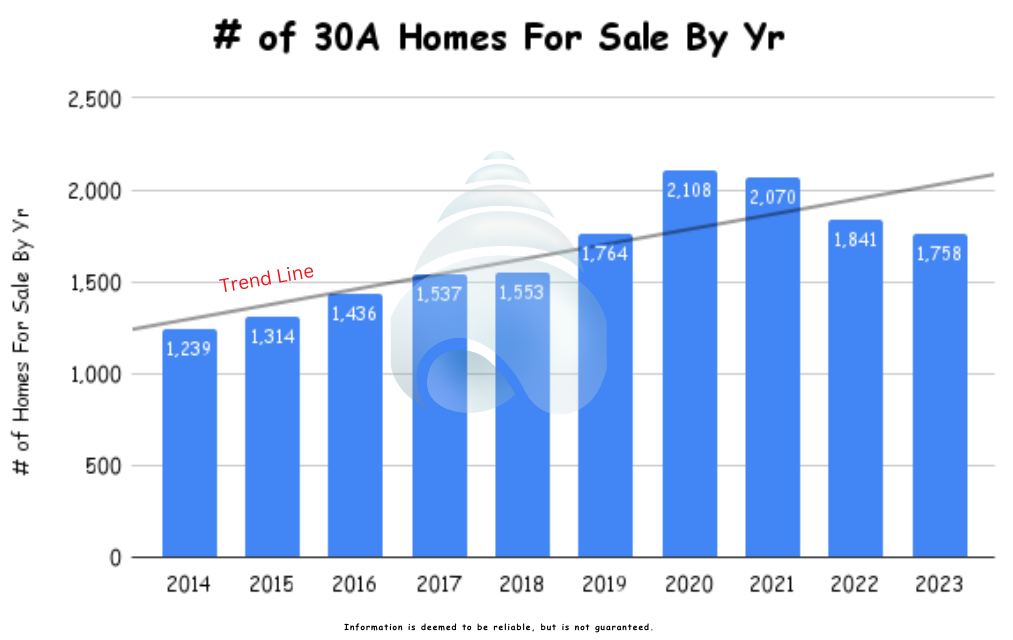

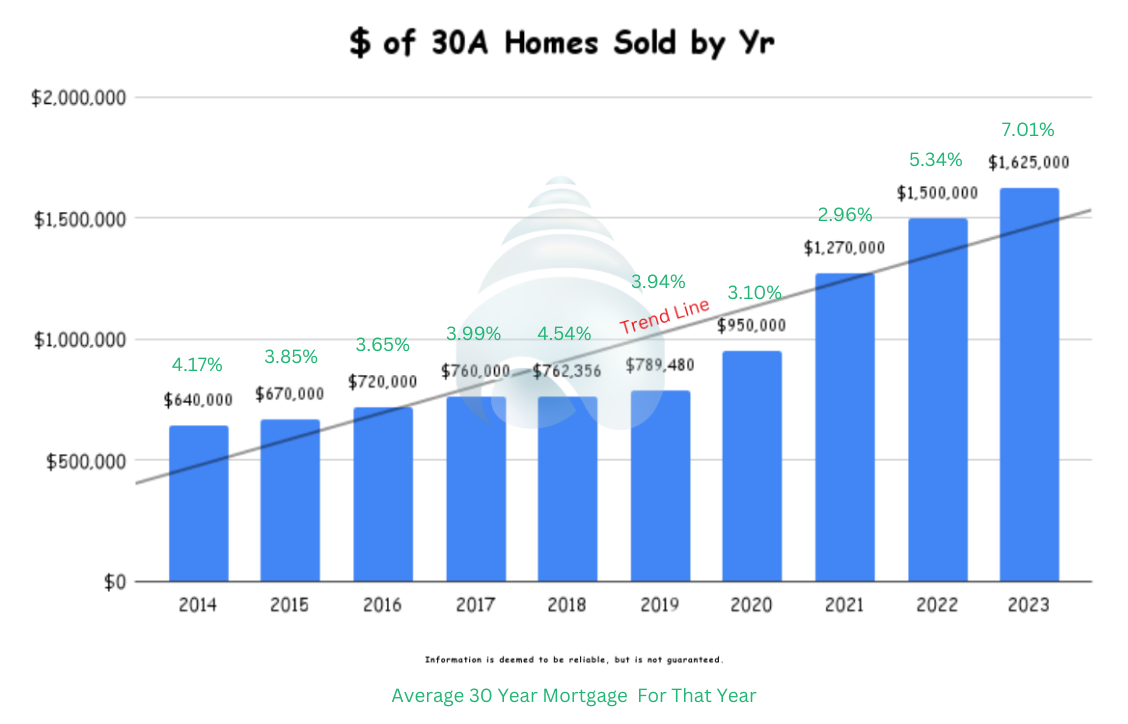

30A Homes

The number of homes for sale on 30A has increased over the years which, if supply and demand forces are in place, should put a significant amount of downward pressure on the prices. If anything, prices should be spiking now as supply plummets. But did it?

Price Reaction to Supply?

Prices did not follow conventional wisdom, by a long shot. Prices for 30A Area condos have clearly climbed and continue to climb regardless of supply.

Mortgage Rate Reaction?

Clearly mortgage rates have not had a profound effect on prices.

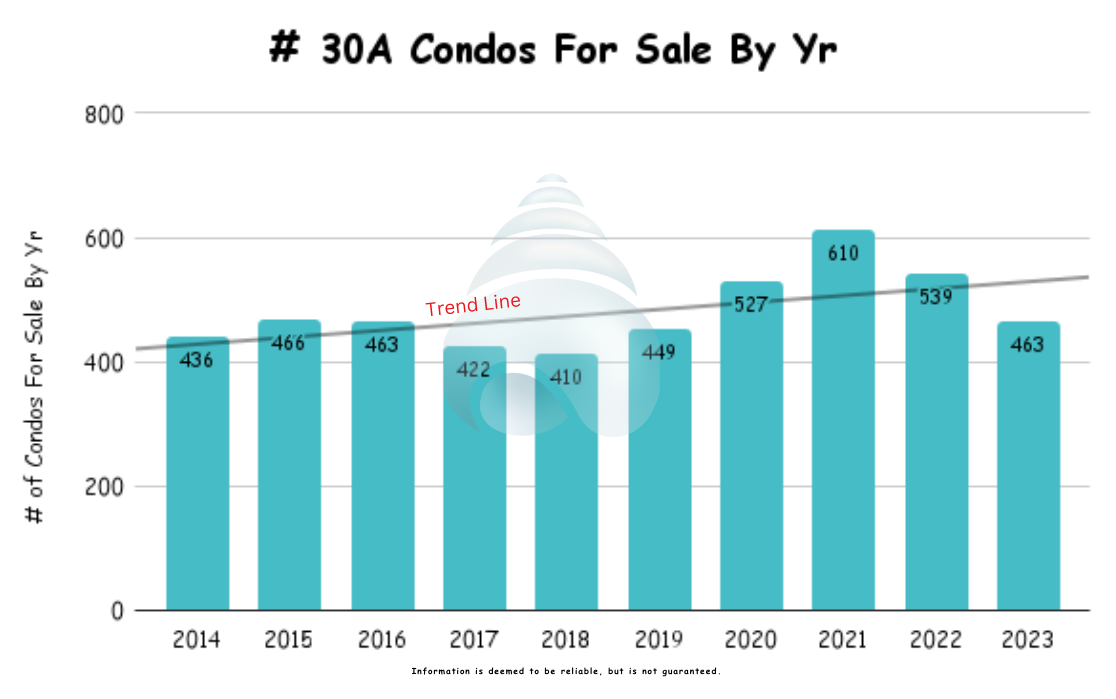

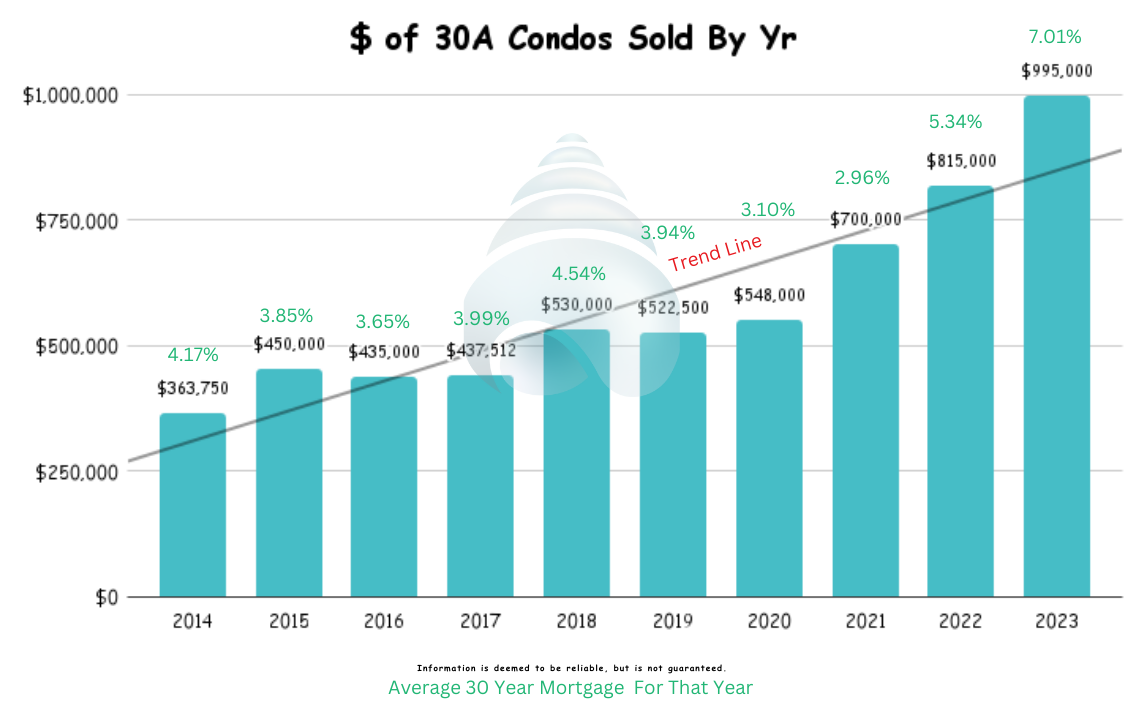

30A Condos

Condos on 30A also follow along this same line. Prices should have been a little up and a little down before dropping as supply climbed in 2020 and 2021. But…

Price Reaction?

Prices are not following conventional wisdom, by a long shot. Prices for 30A Area condos have clearly climbed and continue to climb regardless of supply.

Mortgage Rate Reaction?

Clearly mortgage rates have not had a profound effect on prices.

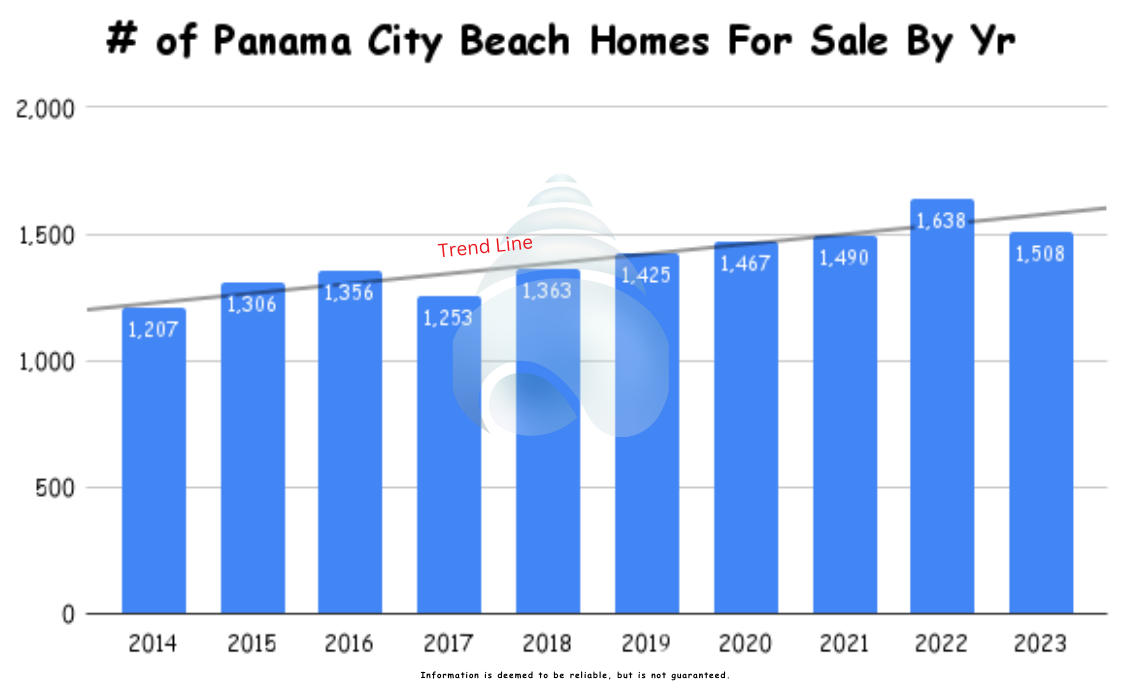

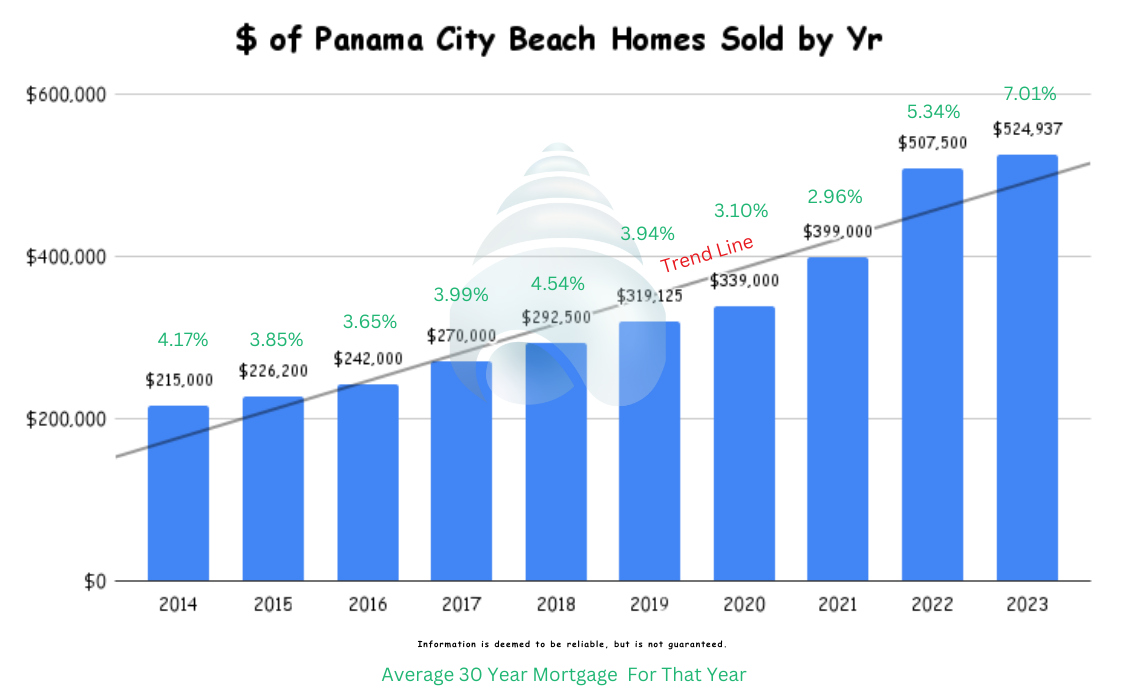

Panama City Beach Homes

Over the last 10 years you can see that the supply of homes for sale in Panama City Beach has mostly increased, spiking in 2022 before falling back in 2023. This should mean that prices dropped in 2022 and climbed in 2023, right? Clearly not the case.

Price Reaction?

Like homes on 30A, Panama City Beach home prices are not following conventional wisdom, by a long shot. Prices for Panama City Beach homes have clearly climbed and continue to climb regardless of supply.

Mortgage Reaction?

Clearly mortgage rates have not had a profound effect on prices.

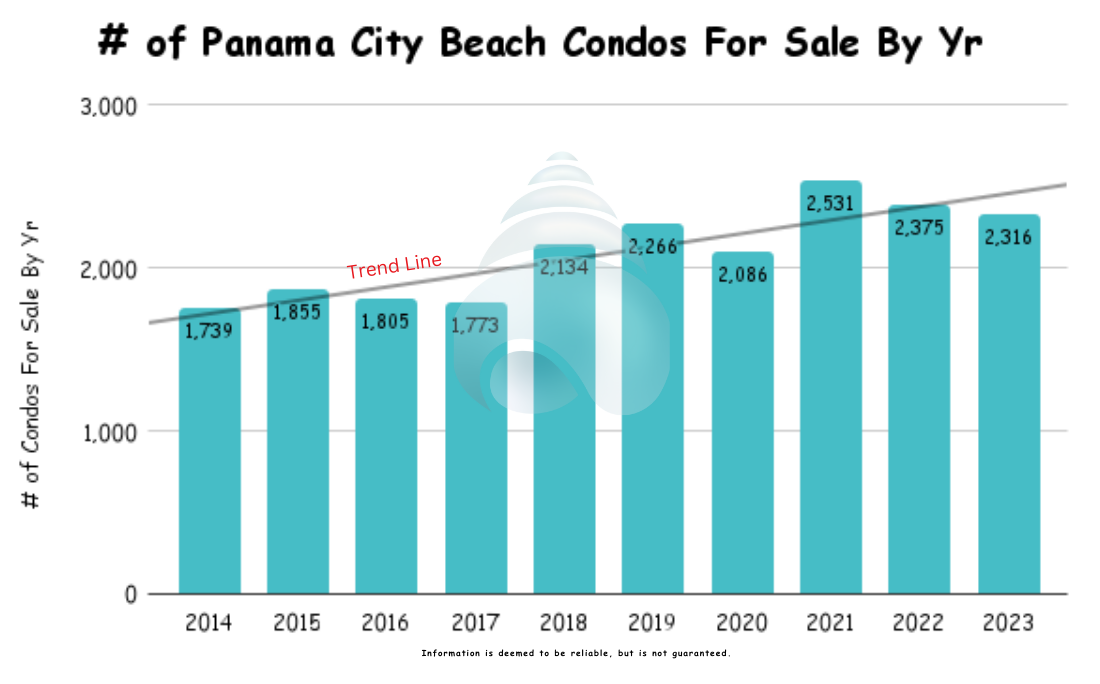

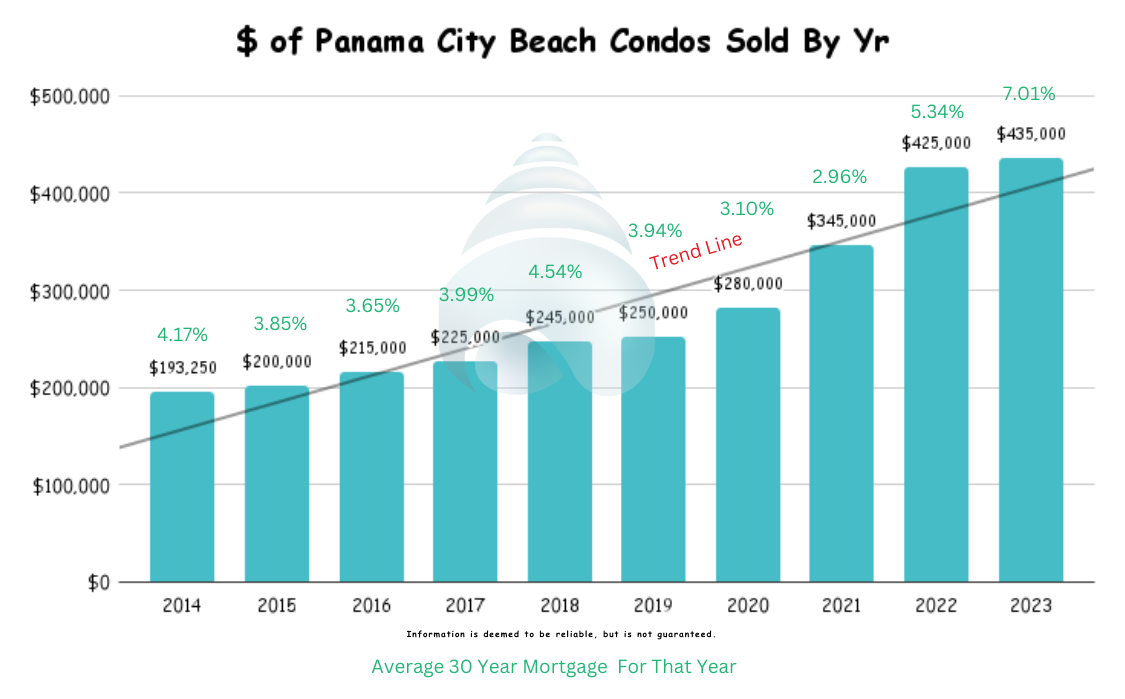

Panama City Beach Condos

Over the last 10 years the supply of condos for sale in Panama City Beach has been up and down, generally carrying an upward trend, spiking in 2021 before falling back in 2022 and 2023. This should mean that prices dropped in 20212 and climbed in 2022 and 2023, right?

The same question as it relates to mortgage rates and condo sales – do condo sale prices drop when rates go up? Do they go up when rates drop?

Price Reaction?

Like homes in Panama City Beach condo prices are not following conventional wisdom, by a long shot. Prices for Panama City Beach condos have clearly climbed and continue to climb regardless of supply or mortgage rates.

What’s Happening With Condo and House Prices?

Consumer Confidence

I think investment real estate – heck investments in general and real estate in general really leans on consumer confidence. When people feel like they have job security, that their future income is going to increase, or that their wealth (401K, IRA, Assets) is growing, they tend to buy stuff like real estate at the beach, or go on vacations where they stay in rental properties like the homes and condos we have here at the beach without much concern for mortgage rates, rent rates, or even the cost to buy. This is contrary to the prevailing wisdom.

What Are We Watching For Clues To What Comes Next?

We are watching for is rate drops because if rates drop when the economy is cooling and people aren’t spending money like they used to, businesses are not hiring or giving bonuses like they used to, and consumers are not buying real estate or renting like they used to. In other words, people do not feel confident in their wealth, their job or their financial future so they pull back.

What We Want

What Should You Do?

Bottom Line?

Committed to your success,

John Moran – CEO

The Smart Beach Investor | Keller Williams Realty AT THE BEACH TEAM We Make Real Estate Easy.